TotalEnergies has sold its 10 per cent interest in a suite of Nigerian oil and gas production licences to Mauritius-based Chappal Energies for $860 million.

Chappal Energies, which made this known, yesterday, said that it entered into a Sale and Purchase Agreement (SPA) to acquire TotalEnergies EP Nigeria Limited’s 10 per cent non-operated interest in its onshore and shallow water assets within the SPDC JV in the Niger Delta.

The company said that “the transaction is expected to close by December 31, 2024. The acquisition includes a 10 per cent interest in 15 Oil Mining Leases (OMLs) and two main export terminals in Nigeria specifically the Forcados and Bonny Terminals that are part of the Shell Petroleum Development Company Joint Venture (SPDC JV).

“In this joint venture, the Nigerian National Petroleum Corporation Limited (NNPCL) holds a 55 per cent stake, SPDC operates with a 30 per cent stake, and Nigerian Agip Oil Company (NAOC) has a five per cent stake.

“The transaction will also see Chappal Energies acquire a 10 per cent participating interest in the three other OMLs within the SPDC JV which are mainly gas producing (specifically OML 23, OML 28 and OML 77), while TotalEnergies will retain an economic interest in these licences which currently account for 40 per cent of Nigeria’s LNG gas supply. Chappal Energies will have rights to the standalone undeveloped oil reserves within these three OMLs.”

It added that “aggregate consideration for the transaction is $860 million. Financing will be provided by a TotalEnergies company entity and/or any financial institution selected by TotalEnergies, Trafigura and a syndicate of international Banks.

“This strategic acquisition increases Chappal Energies’ asset base and adds significant reserves to the company’s balance sheet. The portfolio includes over 40 producing fields with a network of pipelines, flow stations, processing facilities and two major terminals,” the company stated yesterday.

Commenting on the divestment, president exploration & production, at TotalEnergies, Nicolas Terraz, said, “This divestment allows us to focus our onshore Nigeria presence solely on the integrated gas value chain and is designed to ensure the continuity of feed gas supply to Nigeria LNG in the future.”

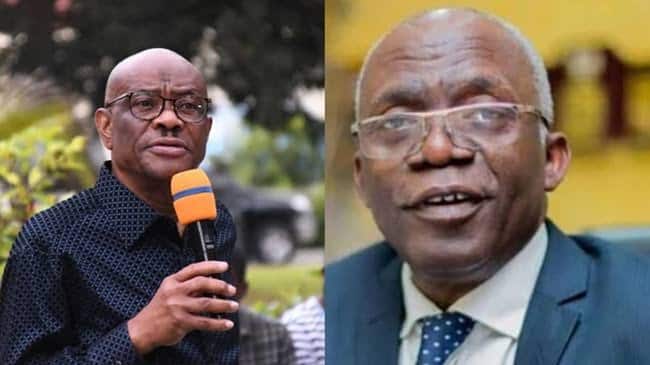

The managing director of Chappal Energies, Ufoma Immanuel said that “this acquisition marks a significant expansion in the Niger Delta, thereby diversifying our Nigeria footprint between the offshore and onshore basins.

“Chappal Energies becomes the first Nigerian company to execute two significant transactions within a 12-month period.”

Immanuel pointed out that the transaction is poised to bring substantial benefits to stakeholders, including shareholders, employees, local communities, and the national economy, saying that the closing is subject to certain conditions, including all regulatory and contractual approvals.

Chappal Energies is an energy company focusing on unlocking latent value in Africa’s oil and gas resources, revitalising ageing assets with solutions that secure longevity in a socially and environmentally sustainable manner.

3 months ago

32

3 months ago

32

![Just In: Tinubu Departs Aso Villa For Late COAS Lagbaja’s Burial [Video]](https://www.naijanews.com/wp-content/uploads/2023/06/20230622_180721.jpg)

English (US) ·

English (US) ·