In my previous article I have explained how sustainability reporting helps to unlock capital, but Mr Hundeyin’s statement presents the opportunity to clarify this unlocking of capital from another perspective, though a dangerous one. I do not agree entirely with Mr Hundeyin when he stated that, “It is and will continue to be 100% OUR prerogative to determine what to do with our hydrocarbons. It is not the rich white men hiding behind these “Climate Advocacy NGOs” who will tell us what to do with our energy reserves… This is simplistic, as I know that capital flows are more complex.

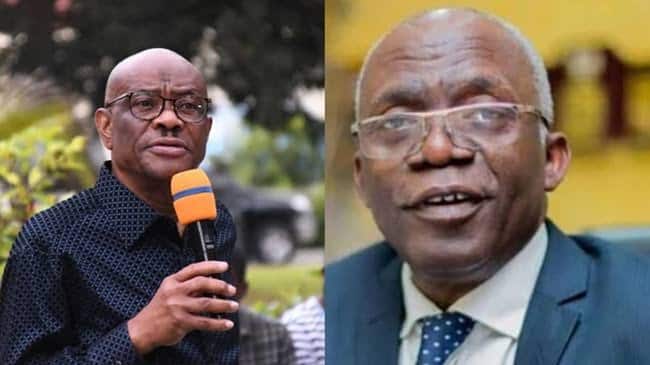

In a recent revelation, the fearless investigative journalist, David Hundeyin, is said to have exposed an attempt to bribe him with $500 (about N800,000) to discredit our Dangote Refinery. I call him fearless for he was visible in taking on politicians during the last election and I thought that was his area of specialisation, not sustainability and climate change. But I guess it is this fearlessness and ability to take on politicians that may have informed the NGO, Dialogue Earth, wanting to recruit him for this job. Dialogue Earth was not stupid, but was smart to find an ally whose voice would have attracted the listening ears of many Nigerians.

Let me make it clear upfront that I support the refining of our crude oil by Dangote Refinery, despite Nigeria’s energy transition plan and commitment. This is especially so in the face of what Nigerians are going through with the removal of fuel subsidy, floating of the exchange rate, hike in electricity tariff and inflation. We just witnessed the hunger protest. I call it hunger protest because that is how the protesters saw it, “we are hungry”, they shouted. Of what use is an energy transition commitment if human beings are going to die of hunger? Only those living can make commitments, not the dead. But can commitments not be renegotiated? I will comment on a just and equitable energy transition in the future.

My interest in this topic is the broader implications for Nigerian and Africa’s economic development. Professor Chukwumerije captured this correctly in his rejoinder to Mr Hundeyin, when he stated as follows: “Where I believe Western environmental NGOs frequently go wrong is that they push Africa too hard on green transition and leaving the oil in the ground, while not lobbying or campaigning hard for enough financial support and technology transfer to develop renewable energy capacities in Africa.”

As accountants, we are interested in the extent to which the sustainability and climate change discourse can help unlock capital flows to Nigeria. We therefore expect these Western environmental NGOs to lobby or campaign hard for enough financial support and technology transfer to develop renewable energy capacities in Nigeria and Africa in general. This will be a typical example of how sustainability and climate change will unlock capital flows.

To put it more clearly, sustainability and climate change compliance will be a conditionality to be fulfilled by developing countries to qualify to access World Bank, IMF, Paris Club and Chinese loans in the future. I repeat this is how sustainability and climate change will unlock capital at the national level; that is why I describe it as being dangerous. Banks in Nigeria can attest to this within the private sector, when sustainable banking principles are forced upon them to access certain Western funds.

Recently Nigeria became the first country in Africa to adopt the International Sustainability Standard Board (ISSB)’s IFRS S1 and IFRS S2. IFRS S2 is on Climate Related Disclosures, which requires organisations to disclose how they are dealing with climate change related risks and opportunities. We thank Dr Olowo, the executive secretary of the Financial Reporting Council of Nigeria for their leadership in this. We also thank Dr Ndidi Nnoli- Edozien, the African representative on the ISSB board, who has done fantastically well in pushing for sustainability to unlock capital flows to Nigeria and Africa.

In my previous article I have explained how sustainability reporting helps to unlock capital, but Mr Hundeyin’s statement presents the opportunity to clarify this unlocking of capital from another perspective, though a dangerous one. I do not agree entirely with Mr Hundeyin when he stated that, “It is and will continue to be 100% OUR prerogative to determine what to do with our hydrocarbons. It is not the rich white men hiding behind these “Climate Advocacy NGOs” who will tell us what to do with our energy reserves… This is simplistic, as I know that capital flows are more complex.

Nigerians need credible journalism. Help us report it.

PREMIUM TIMES delivers fact-based journalism for Nigerians, by Nigerians — and our community of supporters, the readers who donate, make our work possible. Help us bring you and millions of others in-depth, meticulously researched news and information.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Will you support our newsroom with a modest donation to help maintain our commitment to free, accessible news?

As such, the question to be asked is whether it is and will continue to be 100 per cent OUR prerogative to determine what to do with our hydrocarbons when the future crude oil not yet produced has already been mortgaged for IMF, World Bank, Paris Club or Afreximbank loans. Recently Businessday newspaper of 29 January, under the heading “NNPC cash-for-oil deal mortgages 30% of output” reported a commentator saying in frustration that: “…it beggars belief that the Nigerian government in 2024 is embarking on the financialisation of future revenues from oil and gas assets by securitising crude oil and gas output in pursuit of immediate cash.“

I am not questioning the securitisation and financialisation of future crude oil revenue, as I do not have the details. But if I will do so, that will be for another day. I want to draw our attention to the limitless possibilities of how far we can be at the mercy of those who give us cash when we are broke, as they dictate the terms and conditions of the loan and what should be mortgaged for it. Consequently, they can impose climate change compliance as a condition to access the cash, or do I say the loan. This is how sustainability and climate change unlock capital, apart from direct financial support and technology transfer, to develop the renewable energy capacities earlier mentioned.

That is why I support Dr Nnoli-Edozien’s and the FRC’s advocacy for unlocking capital through sustainability reporting because when the time comes, the politicians will commit to sustainability and climate change conditionality if that grants them access to IMF, World Bank and Paris Club loans. You and I will not be there when this is consummated.

To put it more clearly, sustainability and climate change compliance will be a conditionality to be fulfilled by developing countries to qualify to access World Bank, IMF, Paris Club and Chinese loans in the future. I repeat this is how sustainability and climate change will unlock capital at the national level; that is why I describe it as being dangerous. Banks in Nigeria can attest to this within the private sector, when sustainable banking principles are forced upon them to access certain Western funds. You now understand why I know it is a fallacy for Mr Hundeyin to declare “It is and will continue to be 100% OUR prerogative to determine what to do with our hydrocarbons.”

The above explains why I also disagree with Mr Hundeyin’s claim that: “I’m also smart enough to know when rich white men in DC, Houston, Rotterdam and London are trying to use me as a marionette in their 400-year-old coloniser games.” I am not sure that the real colonisers would use a Mr Hundeyin, when they can use politicians. Only Nigerian politicians in power can say, “It is 100% OUR prerogative to determine what to do with our hydrocarbons.” Then, such a politician must be ready not to run to IMF, World Bank, Paris Club or any multilateral finance agencies in the West for a loan. How feasible is that?

That is why I support Dr Nnoli-Edozien’s and the FRC’s advocacy for unlocking capital through sustainability reporting because when the time comes, the politicians will commit to sustainability and climate change conditionality if that grants them access to IMF, World Bank and Paris Club loans. You and I will not be there when this is consummated.

Innocent Okwuosa is the chairman, Nigerian Integrated Reporting Committee and immediate past president, Institute of Chartered Accountants of Nigeria.

.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·