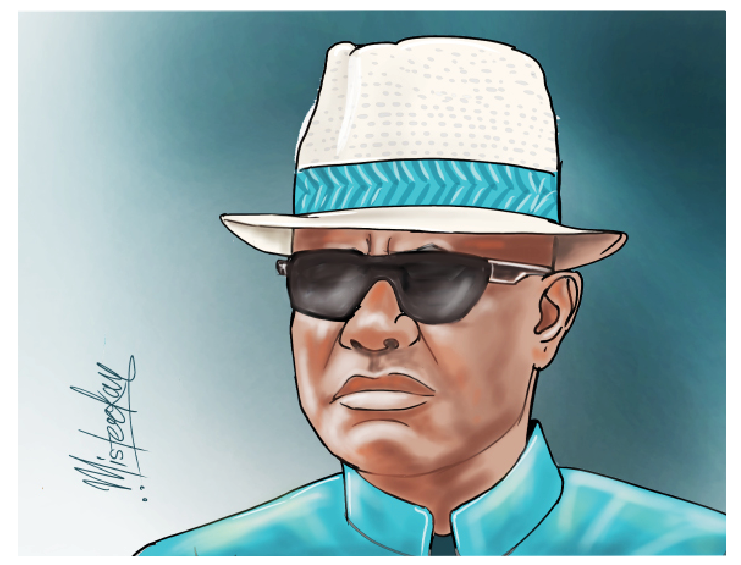

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, on Monday, debunked reports that the rate for Value-Added Tax (VAT) has been adjusted to 10 per cent from 7.5 per cent.

The minister, in a statement signed by him, said VAT rate as contained in relevant tax laws and chargeable on goods and services remains 7.5 per cent.

“The current VAT rate is 7.5 per cent and this is what government is charging on a spectrum of goods and services to which the tax is applicable. Therefore, neither the Federal Government nor any of its agencies will act contrary to what our laws stipulate.

“The tax system stands on a tripod, namely tax policy, tax laws and tax administration. All the three must combine well to give us a sound system that gives vitality to the fiscal position of government.

“Our focus as a government is to use fiscal policy in a manner that promotes and enhances strong and sustainable economic growth, reduces poverty as well as makes businesses to flourish.

“The imputation in some media reports on the issue of VAT and the opinion articles that have sprouted from them seem to wrongly convey the impression that government is out to make life difficult for Nigerians. That is not correct. If anything, the Federal Government has, through its policies, demonstrated that it is committed to creating a congenial environment for businesses to thrive.

“In fact, it is on record that the Federal Government, as part of efforts to bring relief to Nigerians and businesses, recently ordered the stoppage of import duties, tariffs and taxes on rice, wheat, beans and other food items.

Nigerians need credible journalism. Help us report it.

Support journalism driven by facts, created by Nigerians for Nigerians. Our thorough, researched reporting relies on the support of readers like you.

Help us maintain free and accessible news for all with a small donation.

Every contribution guarantees that we can keep delivering important stories —no paywalls, just quality journalism.

“For emphasis, as of today, VAT remains 7.5% and that is what will be charged on all the goods and services that are VAT-able,” Mr Edun said.

The finance minister spoke in response to media reports and claims, including by former Vice President Atiku Abubakar, that the President Bola Tinubu’s government had concluded plans to raise VAT to 10 per cent.

President Bola Ahmed Tinubu

President Bola Ahmed TinubuThere were reports on 3 September that the Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, announced that the committee is proposing legislation to the National Assembly to raise the VAT rate from 7.5 per cent to 10 per cent.

In a statement he circulated on Sunday, Atiku also said that “President Bola Tinubu, alongside his coterie of advisers, has resolved to raise the VAT rate from 7.5% to 10%, even as the NNPCL has announced a soaring PMS price increase at the pump.

“The increase in VAT is set to become the blazing inferno that will consume the very essence of our people.”

The former vice president further claimed that the “move unveils a new era of regressive and punitive policies, and its impact is destined to deepen the domestic cost-of-living crisis and exacerbate Nigeria’s already fragile economic growth.”

But Mr Edun, in his reaction, said that the claims by the former vice president and other critics are wrong.

Earlier in the week, Mr Oyedele had also in a tweet clarified that some media outlets misrepresented his positions.

The tax expert explained that his committee’s proposal focuses on reducing the VAT rate to 0 per cent for essential sectors like food, health, education, rent, transportation, and small businesses.

He explained further that while there may be an upward adjustment in VAT for other items, it is intended to offset the loss in revenue from these exemptions.

READ ALSO: Atiku demands immediate listing of NNPC on Stock Exchange

“Some of the quotes attributed to me in some of the reports are not my words,” he tweeted.

“My committee’s proposal for VAT is to reduce the rate to zero per cent (0%) for food, health, education, and exemption for rent, transportation, and small businesses.

“Our data shows that these are the areas where the average person spend almost all their income, meaning their VAT burden will reduce. The upward rate adjustment is on other items to partly offset the reduction in rate and exemption for basic consumptions ensuring that the masses are protected.”

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·