Sales of new homes in the United States declined last month.

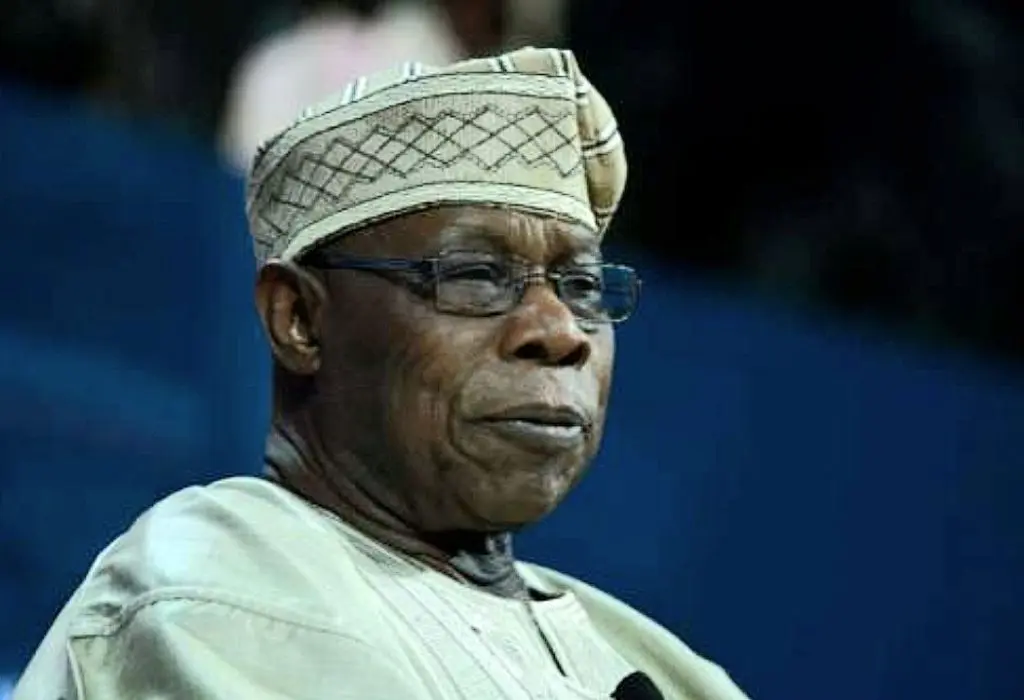

Photo: Brandon Bell / GETTY IMAGES NORTH AMERICA/Getty Images via AFP/File

Sales of new homes in the United States declined last month.

Photo: Brandon Bell / GETTY IMAGES NORTH AMERICA/Getty Images via AFP/FileSource: AFP

Sales of new homes in the United States were weaker than traders expected last month, according to government data published Wednesday, as mortgage rates remained high.

There were 619,00 new single-family home sales made in the 12 months to May on a seasonally adjusted basis, the Commerce Department said in a statement.

This was 11.3 percent below April's revised figure of 698,000, and also less than market expectations of 650,000 sales, according to data from Briefing.com.

"New home sales surprised to the downside," Oxford Economics lead US economist Nancy Vanden Houten wrote in a note to clients, adding that the upward revisions to prior months had taken "some of the sting out of the weak May reading."

The current subdued sales figures also extend to existing home sales, which came in at a seasonally adjusted annual rate of 4.11 million last month, according to recent data from the National Association of Realtors.

Home sales have been impacted by the Federal Reserve's decision to hike its key short-term lending rate to a 23-year high as it looks to tackle elevated inflation, which has helped push other lending rates higher and indirectly affected mortgage rates as well.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

The popular 30-year fixed-rate mortgage sits at just under 6.9 percent, according to the government-sponsored firm Freddie Mac, which buys and guarantees existing mortgages.

The median sales price of homes sold in May fell to $417,400, the Commerce Department said.

Source: AFP

English (US) ·

English (US) ·