A Nigerian multinational energy company, Oando Plc, has acquired a 100 per cent shareholder interest in the Nigerian Agip Oil Company (NAOC) from Eni, an Italian energy company, for $783 million.

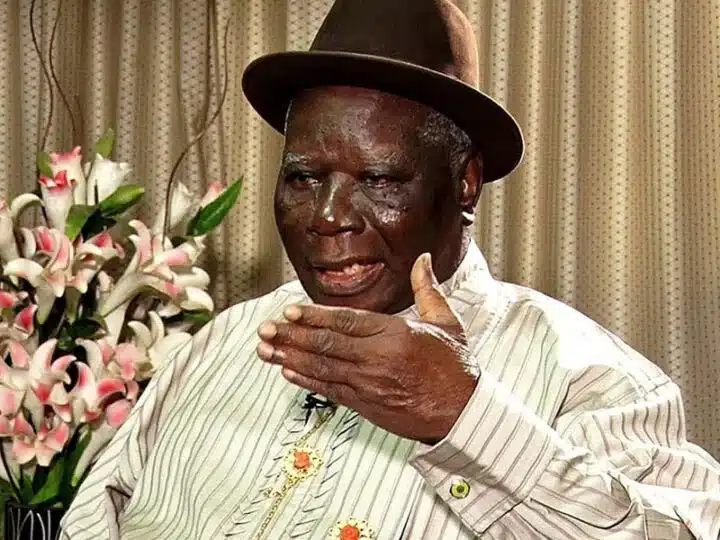

Mr Wale Tinubu, Group Chief Executive Officer of Oando, disclosed this in a notification sent to the Nigerian Exchange Ltd. (NGX) on Thursday in Lagos.

Tinubu said the total amount of the transaction included consideration for the asset and reimbursement.

He stated that the acquisition is a significant milestone in Oando’s long-term strategy to expand its upstream operations and strengthen its position in the Nigerian oil and gas sector.

According to him, the transaction increases Oando’s current participating interests in OMLs 60, 61, 62, and 63 from 20 to 40 per cent.

The Group CEO said the deal had also increased Oando’s ownership stake in all NEPL/NAOC/OOL Joint Venture assets and infrastructure.

He listed the ownership stake to include 40 discovered oil and gas fields, of which 24 are currently producing, approximately 40 identified prospects and leads, as well as 12 production stations, and approximately 1,490 km of pipelines.

Also included are three gas processing plants—the Brass River Oil Terminal, Kwale-Okpai phases one and two power plants with a total nameplate capacity of 960 MW, and associated infrastructure.

Tinubu explained that based on the 2022 reserves estimates, Oando’s total reserves stood at 505.6 MMboe and that the transaction would deliver a 98 per cent increase of 493.6 MMboe, bringing the total reserves to 1.0 Bnboe.

He noted that the transaction would contribute significantly to the company’s cash flows, as it had immediate cash-generative value.

“This announcement is the culmination of ten years of toil, resilience, and an unwavering belief in the realization of our ambition since the 2014 entry into the Joint Venture via the acquisition of ConocoPhillips’ Nigerian portfolio.

“It is a win for Oando and every indigenous energy player, as we take our destiny into our own hands and play a pivotal role in this next phase of the nation’s upstream evolution.

“With our assumption of the role of operator, our immediate focus is on optimizing the assets’ immense potential, advancing production, and contributing to our strategic objectives.

“We will do this while prioritizing responsible practices and sustainable development, ensuring a balanced approach with our host communities.

“We will also ensure environmental stewardship as we complement the nation’s plan to boost production output,” he said.

The Oando boss said that the company would continue to pursue strategic diversification opportunities within the broader energy sector that provide enhanced growth and value creation for its stakeholders.

He emphasised the need to develop the clean energy and agri-feedstock sectors, as well as the energy infrastructure and mining sectors.

English (US) ·

English (US) ·