- Bank directors have opposed the views of Femi Otedola and Tony Elumelu on the proposed windfall tax by the Nigerian government

- The bank directors disclosed that the views of the two billionaires do not represent those of the banking community

- They said the bank directors will make their views known at a scheduled meeting in August

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment, and the economy for over a decade.

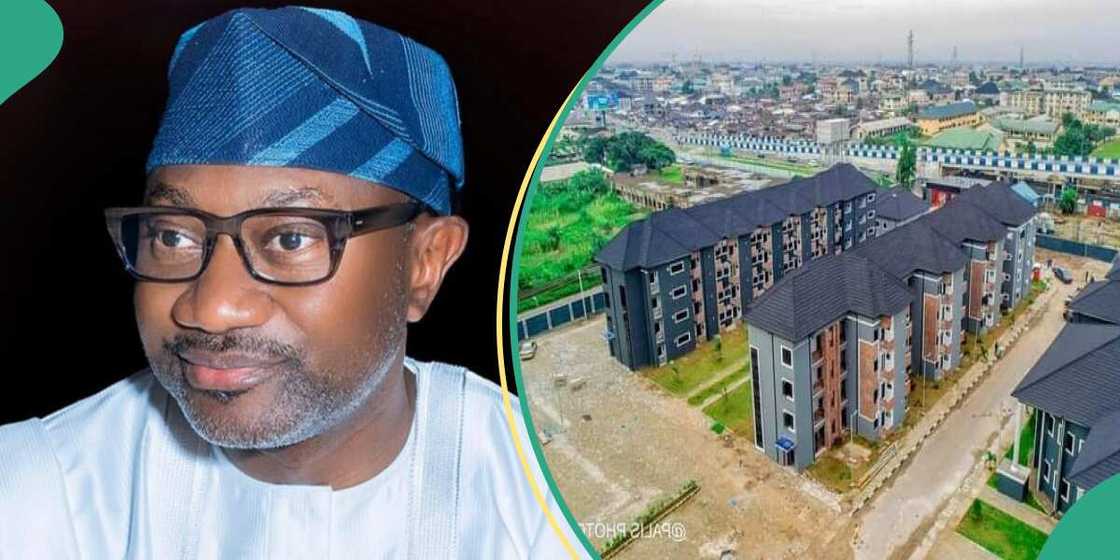

The Bank Directors Association of Nigeria (BDAN), has opposed the views expressed by the Chairman of First Bank of Nigeria, Femi Otedola, and UBA Chairman, Tony Elumely over the proposed windfall tax.

The directors stated that the views of the two billionaires in support of the federal government’s proposed taxing foreign exchange earnings represent their stance and not the banking community.

Source: UGC

Otedola says banks splurge on private jets

The National Assembly recently passed a bill to impose a ‘windfall tax’ on commercial banks that benefited from the Central Bank of Nigeria (CBN) subsidies on FX with stakeholders.

Legit.ng reported that Nigerian billionaire, Otedola recently endorsed the new policy, criticizing the bank officials for their extravagant spending and purchases and maintenance of private jets.

Otedola said:

“Nigerian banks are spending an estimated $50 million annually just on maintaining private jets, with over $500 million spent on purchasing nine private jets by four banks.”Elumelu praises FG’s proposed windfall tax

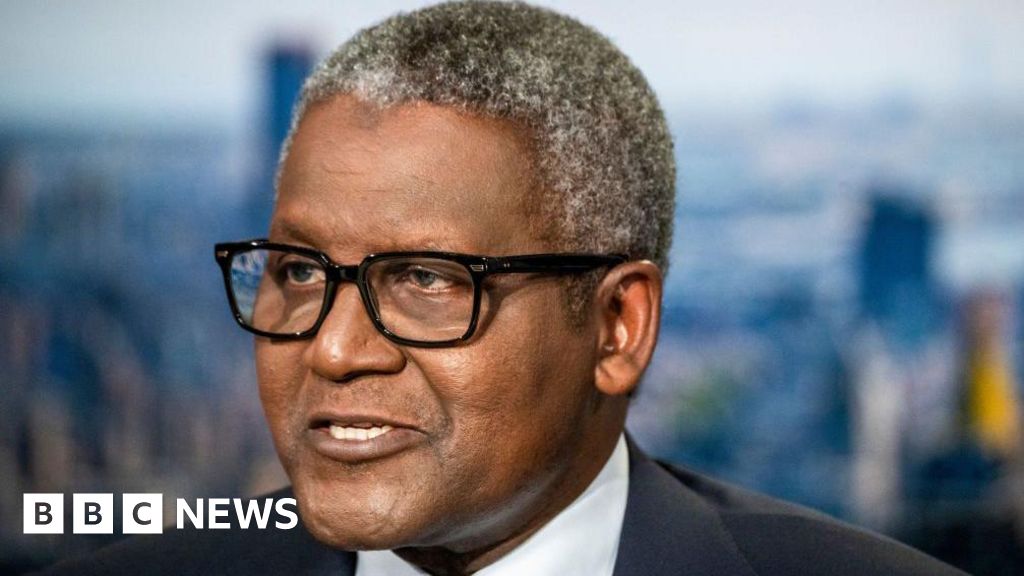

Reports say that the Chairman of UBA, Tony Elumelu, also took sides with the Nigerian government over the proposed levy saying the move will ease poverty in the country.

However, the bank directors disclosed that the views expressed by the two billionaires did not represent the banking industry and assured stakeholders its official position would be revealed during a scheduled board meeting on August 12, 2024.

According to reports, Mustafa Chike-Obi, the BDAN Chairman disclosed on social media that the views of Otedola and Elumelu do not represent the banking community and that the association will communicate its position at the meeting.

CBN moves to crash dollar again

Legit.ng earlier reported that the Central Bank of Nigeria (CBN) has announced that it will reintroduce the Retail Dutch Auction System (rDAS) starting Wednesday, August 7, 2024.

The system will see the apex bank sell foreign exchange to end users and authorized dealer banks.

According to a circular by CBN, the bank directed authorized dealer banks to furnish it with a legitimate list of outstanding Forex demands by users containing the customer’s name, address, and contact information, such as email, phone number, BVN, account number, TAX Identification Number (TIN), the purpose for the FX requests, Form A or Form M, and Letter of Credit Number.

Source: Legit.ng

English (US) ·

English (US) ·