- CB has directed commercial, merchant and non-interest banks to open domiciliary accounts for participants in its new dorm account guidelines

- The guideline clarifies regulatory expectations from the bank on their participation in the Foreign Currency Scheme

- It said a bank should permit a participant to exchange part or the whole ITFC in the domiciliary account for naira at the prevailing exchange rate

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

The Central Bank of Nigeria (CBN) has asked commercial, merchant and non-interest banks (CMNIBs) to open domiciliary accounts for participants in its new guidelines on foreign currency disclosure, deposit, repatriation and investment scheme, 2024.

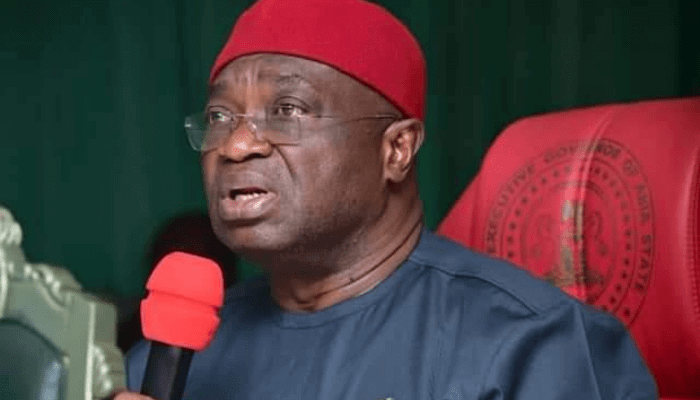

The new guidelines were adjusted on October 25, 2024, and issued by Wale Edun, the Minister of Finance.

Source: Getty Images

New guidelines seek to mop foreign currencies

According to the CBN, the guideline clarifies regulatory expectations from the financial institutions on their participation in the Foreign Currency Disclosure, Deposit, Repatriation, and Investment Scheme, 2024.

The bank said when a financial institution confirms that an applicant has complied with the requirements of Section 3.1 of the guideline, it shall receive the ITFCs into the designated domiciliary account and forward a report to the bank in conformity with the approved template.

The new rules show how to deposit and withdraw FX

Regarding withdrawals from the designated dorm account and termination of investment, the guideline said the banks should impose any restriction on the withdrawal from the participant's designated domiciliary account, termination of any investment made, or allowing an investment instrument or permissible investment sector with such ITFC.

Per the regulation, a bank shall permit a participant to exchange part or the whole ITFC in the domiciliary account for naira at the prevailing exchange rate if such conversions are adequately disclosed and reported to the bank’s foreign exchange returns.

It added:

“CMNIBs may trade with any deposited ITFC not immediately invested by a participant, provided that the funds would be made available to the participant when needed. Interest on uninvested Funds Interest payment by CMNIBs on the balance in the designated domiciliary account shall be in line with relevant provisions of the Guide to Charges by Banks and Other Financial Institutions in Nigeria.”CBN asks banks to allow customers to withdraw $10,000

A previous report by Legit.ng said CBN released new directives to Deposit Money Banks (DMBs) regarding the operation of domiciliary bank accounts in the country.

DMBs are commercial banks that accept deposits from customers from any part of the country and conduct other banking services as prescribed by the CBN.

In a statement, the CBN directed that commercial banks should allow customers to now withdraw up to $10,000 daily from their domiciliary accounts.

Before the changes, Legit.ng understood that withdrawal from a domiciliary account had a limit of $10,000 per month.

CBN hopes that the removal of restrictions will encourage more Nigerians to use official channels for forex transactions, thereby enhancing liquidity and transparency in the foreign exchange market.

CBN addresses alleged plans to convert dorm accounts to Naira

Legit.ng earlier reported that there are speculations that the apex bank is eyeing the dollars and other foreign currencies domiciled in commercial banks as it pushes for lenders to start selling forex directly to customers.

However, Osita Nwanisobi, the acting director of corporate communications, CBN, said there's no truth in the report, and the financial regulator has put measures in place to monitor forex sales of banks.

He said those behind the report are criminal speculators, whose intention is to cause panic in the foreign exchange market.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng

English (US) ·

English (US) ·