Nigeria’s Presidential Fiscal Policy and Tax Reforms Committee has proposed an increase in Value Added Tax (VAT) on non-essential goods to offset VAT reduction on essential items like food, healthcare, and education.

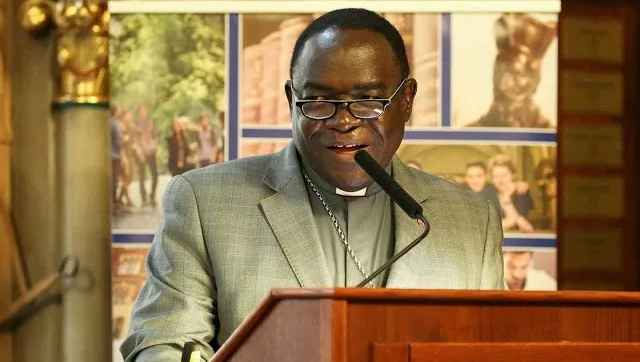

The committee chair, Taiwo Oyedele, said this in a repeat post via his X handle on Monday.

Mr Oyedele said the committee is also proposing to reduce the VAT rate to zero per cent (0%) on food, health, education, with exemption for rent, transportation, and small businesses.

“The upward rate adjustment is on non-essential items to partly offset the impact of the reduction in rate and exemption for essential items ensuring that the masses are protected and providing some cushion for states who earn 85% of VAT revenue.

“Businesses will also get full credit for the VAT they pay on their assets and services, thereby lowering their overall costs and moderating inflation,” he said.

Under the proposal, he said essential goods and services such as food, rent, transport, healthcare, and education will either be exempted from VAT or attract a zero per cent rate.

This move, he said, will significantly reduce the tax pressure on households, especially as the National Bureau of Statistics (NBS) data indicates that Nigerians spend most of their income on these basic needs.

Nigerians need credible journalism. Help us report it.

Support journalism driven by facts, created by Nigerians for Nigerians. Our thorough, researched reporting relies on the support of readers like you.

Help us maintain free and accessible news for all with a small donation.

Every contribution guarantees that we can keep delivering important stories —no paywalls, just quality journalism.

The proposed VAT reforms also aim to streamline Nigeria’s tax system by discontinuing other consumption taxes and focusing solely on VAT where applicable.

A key benefit of the reforms is that all businesses will be able to recover VAT on their assets and services, lowering operational costs and reducing inflationary pressures. Additionally, more than 97 per cent of small- and medium-sized enterprises (SMEs) will be exempt from charging VAT on their sales, offering further relief to smaller businesses.

Also, the reforms promise quicker VAT refunds, without the need for extensive tax audits, which often cause delays under the current system.

The committee also proposed a more equitable distribution of VAT revenues among states, while export of services and intellectual property will attract zero per cent VAT.

The committee’s proposal had earlier generated ripples as some media outlets reported that there was an imminent increase in VAT from 7.5 per cent to 10 per cent.

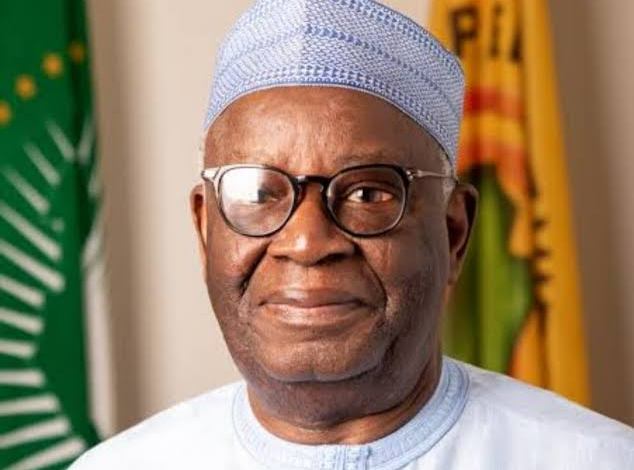

In his reaction to the reports, a former Nigerian Vice President, Atiku Abubakar, said that President Bola Tinubu’s government had concluded plans to add to Nigerians’ burden by raising VAT to 10 per cent.

In a statement he circulated on Sunday, Atiku also said that President Bola Tinubu, alongside his coterie of advisers, resolved to raise the VAT rate even as the NNPC has announced a soaring PMS price increase at the pump.

“The increase in VAT is set to become the blazing inferno that will consume the very essence of our people,” Atiku said.

But the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, also on Monday said the VAT rate as contained in relevant tax laws and chargeable on goods and services remained 7.5 per cent.

“The current VAT rate is 7.5 per cent and this is what the government is charging on a spectrum of goods and services to which the tax is applicable. Therefore, neither the Federal Government nor any of its agencies will act contrary to what our laws stipulate,” the minister said.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·