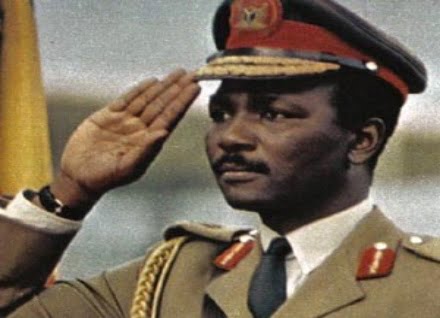

With over 30 years of experience in underwriting across Africa, including Nigeria, Kenya, and Liberia, Stephen Alangbo is currently the managing director and CEO of Cornerstone Insurance Plc. He achieved this position through hard work, dedication, passion, and resourcefulness.

Since becoming the managing director and CEO of Cornerstone Insurance Plc in July 2023, Stephen Alangbo , has achieved several milestones. Recently, he was recognised as one of the Top 25 CEOs of the Year at the Business Day Media Awards held in Victoria Island, Lagos. Additionally, his company was honoured as the African Insurance Company of the Year by the African Insurance Organisation at their prestigious awards ceremony in Windhoek, Namibia.

As a key stakeholder and shareholder in the insurance industry across the African continent, he stated, “My objective has always been to change the negative perception of insurance and to help the public appreciate the value of the insurance business.”

He said, “Incidentally, I sought experience in other countries to understand how the insurance profession is practiced there. I returned to Nigeria and rejoined Cornerstone Insurance Plc in 2022. Previously, I had joined an insurance firm in Nigeria from 2014 to 2015, driven by my dream to enhance the company’s image. During my time there, we won several awards, including being recognized as the Insurance Company to Inspire Africa in 2019, and I was nominated for African Insurance CEO of the Year. This experience reinforced my belief that positively projecting insurance is essential, especially when many people still think insurance companies don’t pay claims.”

Profitability

For him, the insurance profession is profitable for those who are committed and passionate about their work. He emphasised that it offers the freedom and leverage to pursue one’s aspirations. Many impactful individuals, including the founder of his company, have emerged from the insurance industry, contributing significantly to national development and various areas of life.

You can decide to be an underwriter, actuary, reinsurer, an insurance broker or agent and you can even work as a regulator, hence, the sky is wide for everybody to make a fortune out of the industry, he pointed out.

Claims And Negative Insurance Mindset

Nigerians, according to him, have the mindset that insurance companies don’t pay claims, stating that, this perception is a wrong notion as insurance companies nationwide have always paid genuine claims running into trillions of Naira in recent years.

“For instance, because we are sure of who we are, we have challenged the insuring public who have a genuine claims unpaid in Cornerstone to identify themselves but none came out. That shows the attention we pay to claims payment,” he boasted.

Stating that, because of this negative perception, insurance penetration in Nigeria is very low, he, however, said, this is an indication to a wise investor to be able to know this is a potential market, noting that, “because penetration is low, any little improvement to increase penetration will give a lot of reward to wise investors. All we need to do is to ensure that we have a culture of insurance.”

Noting that the government through the regulatory and enforcement authorities has increased its oversight functions to ensure more people are mobilised into the insurance net, he said: “In Nigeria today, to drive your car, you need a minimum of third-party insurance and motorists are complying, although, it could be better.

“Rate of compliance has risen compared to 4 years ago since people know they can be sanctioned for violation, which points to an improvement in adoption. The same goes for employees in an organisation who don’t have group life insurance in place. There’s also a sanction prescribed in the Pension Reform Act(2014) which made it mandatory for employers of labour to have a group life insurance policy in place for their employees and complaince in this category has risen as well.

“Insurance of public building is becoming very compulsory and a lot of States are now domesticating and adopting it. This is good for the economy because we have had cases of buildings with lots of investment in it collapsed and the victims were left poor again.

“What insurance does is that, before you insure a property or an asset, the insurance company also assesses the asset to see if it’s insurable, and for a contractor who is involved in construction of public buildings, there are specific that insurers will want to see in your properties. So, that gives you some major caution in ensuring that you use quality materials in building your houses.

“Similarly, there are some risks mitigation or risk assessment that are done to give you snippets on how to prevent fire, for example, in building and giving you a discount for having some of these measures like a sprinkler or fire extinguisher in the houses or having good housekeeping act. That will be an encouragement for you to pay lower premium and that, in essence, makes you to be conscious of environment and better for the nation.”

When disasters such as fire outbreak, flooding, building collapse and so on struck, he urged federal and state governments apparatus to desist from dipping hands into government purse to pay the victims, but rather push that responsibility to insurance companies after adequate coverage had earlier been Initiated.

To him, “So, the nation is not losing resources as a result of fire because there have been some precautionary conscious efforts by insurance companies to bring it to the attention of the owner of the property that they need to ensure that they prevent fire.

So, all these have a lot of implication in the development of a nation, and by the time people appreciate it, investors who sees the improvement in premium generation in the insurance sector will be attracted to invest more in that sector.

“As a result, the fund is built such that insurance companies can invest in infrastructure, invest in technology to enhance distribution, and the insurance business is made to expand, hence, there is growth in economy. The fund is made available for Infrastructure development to the state or the federal government which most other developed countries are taking advantage of. “

Relevance Of Insurance For National Devt

As a nation, he said, “if we adopt insurance, it will be to the benefit of everybody. However, insurers are facing challenge in this regards. When you have markets where the marketers have invested the whole of their income in their goods and there is one person who is within the market that was not careful enough, and fires started from that shop or that location, spread and gutted the goods of others who have insured, then, insurance companies will have to cough out claims to those insured for a negligence of an uninsured. That is not profitable.

“The challenge that insurance industry is having is that, only very few people within the market take insurance and the principle of insurance is to take the premium of many to pay the claim of few who are unfortunate. So, if you have a situation in which take for example, you have a thousand people in the market and only 20 took insurance policies, in essence, it would be very challenging in case of fire for the insurance company to be able to cope because they have collected little premium.

“But if there is full insurance adoption, take for example, in the whole of the market, about 80% or 90% of them took up insurance, that would mean about 800 people out of 900 people took up insurance, then, it would be easier to compensate. But that’s not happening and that’s why insurers sometimes are a bit concerned and skeptical about insuring marketplaces.

“As an organisation, our strategy is to be able to build positive image of insurance and Cornerstone Insurance. We made Cornerstone a brand to take your insurance policy.

We have also emphasised the priority of payment of genuine claim in Cornerstone Insurance because we believes the best form of publicity an insurance company can undertake is payment of claims.”

Leveraging Innovation For Business Growth

Innovation is an essential ingredient to survive in a competition world, especially, in this age and time and failure to be innovative is disastrous for business survival and growth, Alangbo said.

While advising aspiring entrepreneurs, especially, in the business of insurance to be innovative in products designs, he added that, good products always entice customers’ admiration.

“In Cornerstone, Top 25 CEOs Business Day Media Awards and the African Insurance Company of the Year Award were a recognition of our innovations in product designs and delivery as well as claims management which stand us out among our peers.

“So, we are very excited for these awards. It’s a recognition of lots of effort that we are putting in. These are what came as a result of many of the things that we are doing and we are very excited about them.

“What this is doing for us is that, it is making us to raise the bar because, as African insurance company of the year, expectations are high. The award assist us in building our processes to ensure proper and flexible distribution of products and services, while improving our brand. Similarly, we are designing products to ensure that we build capacity within the system now. Hence, we are very happy having this additional awards as one of the top CEOs in Nigeria.

“Remember, this is not top CEOs in insurance industry, it is top CEOs in Nigeria . This is a compensation for achieving some of our goals to make insurance being appreciated by the insuring public and these awards will assist us to achieve more. That shows we have an insurance company that is competing with any of the CEOs of different sectors in Nigeria.”

Saying this will give the insuring public the opportunity to learn and to know more about what Cornerstone is doing and also enhance its brand, he added that, “when we are selling our products and services, the prospective policyholders have confidence in Cornerstone that he or she is dealing with a credible insurer.”

Biography

Mr. Stephen Alangbo became the company’s new managing director/CEO of the company effective 3rd July 2023. Alangbo succeeds Mr. Ganiyu Musa, the outgone group managing director of the underwriting firm.

Stephen Alangbo was appointed to the Board of Cornerstone Insurance in 2022 as the executive director, Technical Operations after a year stint in the same position in Tangerine Life Insurance Limited. He was part of the management team responsible for the tremendous increase in Cornerstone’s performance in 2022, with a group GPW of about N25billion representing 13% growth in PBT. He has served as managing director in various organisations in the insurance industry within and outside Nigeria.

He was MD/CEO, Capex Life Assurance Company Limited Kenya, MD/CEO Capital Express Assurance Liberia Limited, and managing director of ARM Life PLC. Stephen was the past chairman of Life Offices Committee (LOC) of Nigeria Insurers Association (NIA), former Council Member of NIA, and was once a facilitator in AIO speaking on Life Assurance in the West African Region.

He brings over 30 years quality experience to the company with competence ranging from micro-insurance, enterprise risk, strategic business development, insurance technical operations, product design & development, and corporate governance.

Stephen obtained his B.Sc. (Mathematics with Statistics) from the University of Lagos and his MBA from the ESUT Business School, Enugu. He has undergone various training both locally and internationally and received several awards for his outstanding performance both in school and out of school. He is also an Associate Member of the Chartered Insurance Institute of Nigeria (CIIN).

20 hours ago

69

20 hours ago

69

English (US) ·

English (US) ·