The corporation said it achieved a favourable reduction in total liabilities, from N6.282 trillion in 2022 to N5.739 trillion in 2023, primarily due to repayments of the N500 billion Central Bank of Nigeria (CBN) loan.

Reading Time: 1 mins read

Despite challenging macroeconomic conditions coupled with economic headwinds, Asset Management Corporation of Nigeria (AMCON) achieved a remarkable triple-digit growth of 202% from NGN34.730 billion in the previous year to NGN108.433 billion in 2023.

This was contained in the latest press release issued today by Jude Nwauzor, head corporate communications department of the debt recovery agency of the Federal Government.

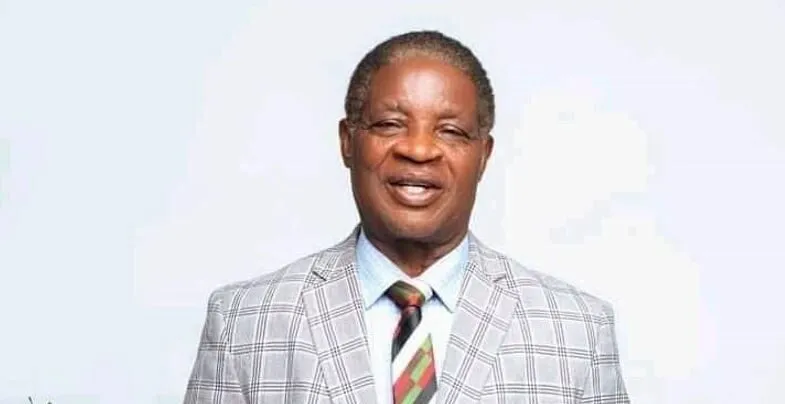

A breakdown of this achievement showed that AMCON, currently led by Gbenga Alade as Managing Director/Chief Executive Officer, achieved a Year-on-Year (YoY) growth in profit of 212% from N34.730 billion in the financial year, which ended on December 31, 2022, to N108.433 billion in the period ended December 31, 2023.

The report disclosed that fair valuation gains on Eligible Bank Assets (EBAs) increased to N40.9 billion in 2023 from a loss of N187.9 billion in 2022. The equity portfolio recorded 82% growth in 2023, amounting to N43 billion as compared with N7.9 billion in 2022. The significant trading gains is a result of an improved performance in the stock market.

Interestingly, the corporation achieved a favourable reduction in total liabilities, from N6.282 trillion in 2022 to N5.739 trillion in 2023, primarily due to repayments of the N500 billion Central Bank of Nigeria (CBN) loan. The Corporation also achieved 89% achievement of its revenue budget in 2023, as the total recovery in 2023 stood at N125.2 billion.

A breakdown of the recovery showed that AMCON achieved N81.65 billion in collections from various obligors, N17.8 billion from share sales, N15.5billion reinvestment income, N6 billion as proceed from sale of properties, N3.8 billion dividend income and N0.5 billion from rental income despite the country’s challenging economic environment, occasioned by the removal of subsidy and floatation of the naira.

The executive management of the Corporation led by Mr Alade said AMCON is strategically positioned to continue with the positive trajectory achieved in the year 2023, with special emphasis on improved recoveries and efficient realisation of value from disposal of forfeited assets in furtherance of the Corporation’s mandate.

Nigerians need credible journalism. Help us report it.

PREMIUM TIMES delivers fact-based journalism for Nigerians, by Nigerians — and our community of supporters, the readers who donate, make our work possible. Help us bring you and millions of others in-depth, meticulously researched news and information.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Will you support our newsroom with a modest donation to help maintain our commitment to free, accessible news?

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·