- The Central Bank of Nigeria has announced the next planned meeting of the monetary policy committee

- The MPC meeting's objective is to evaluate the country's financial and economic situation

- According to the CBN governor, the committee's efforts to reduce inflation are making a difference

Legit.ng journalist Zainab Iwayemi has over 3-year-experience covering the Economy, Technology, and Capital Market.

The Monetary Policy Committee (MPC) meeting that is scheduled to take place next has been announced by the Central Bank of Nigeria (CBN).

Source: Getty Images

The CBN stated in a statement on Tuesday that the 296th MPC will convene on July 22 and 23.

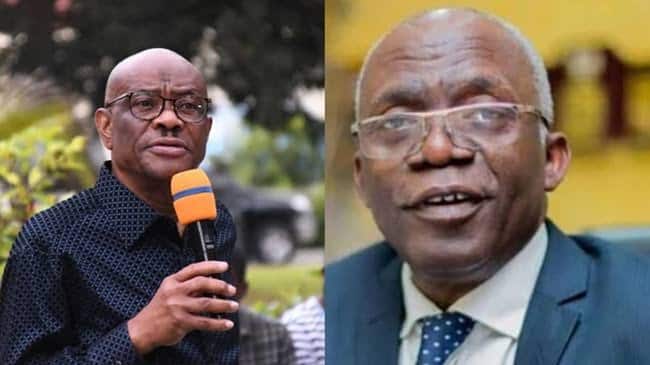

The committee, which is headed by CBN governor Olayemi Cardoso, is the bank's highest policy-making body.

The purpose of the MPC meeting is to assess the financial and economic status of the nation and decide on the best course for short- to medium-term monetary policy, The Cable reported.

The committee increased the monetary policy rate (MPR), which sets interest rate benchmarks, from 24.75% to 26.25% during its most recent meeting, which took place on May 20 and 21.

The asymmetric corridor around the MPR at +100 and -300 basis points was kept by the MPC.

Additionally, the committee decided to keep the cash reserve ratio (CRR) at 14% for commercial banks and 45% for deposit money institutions.

After the meeting, Cardoso told the media that the interest rate increase was meant to control inflation.

He added that the committee's attempts to keep inflation under control are having an impact.

Meanwhile, the naira recently depreciated against the United States dollar in the official foreign exchange market despite the Central Bank’s recent intervention.

Data from FMDQ securities showed that the naira fell in the Nigerian Autonomous Foreign Exchange Market (NAFEM) to N1,577.29/$1 on Monday, July 15.

CBN releases interest rates on customers' savings accounts

Legit.ng reported that Deposit Money banks (DMBs) have increased their interest rates on deposits to reflect the latest Monetary Policy Rate announced by the Central Bank of Nigeria.

Earlier, the CBN raised the Monetary Policy Rate (MPR) to 24.75% in May 2024 from 22.75% in February 2024.

Checks showed that 18 Nigerian banks now offer their customers at least 7.88% interest on their deposits as of June 28, 2024.

Source: Legit.ng

![[Live Updates] #OndoDecides2024: Ondo State Gubernatorial Election Results](https://www.naijanews.com/wp-content/uploads/2024/11/Ondo-Election-Results-1024x576.png)

English (US) ·

English (US) ·