The Nigeria Deposit Insurance Corporation (NDIC) says account name discrepancies in Bank Verification Number (BVN) linked alternate accounts of some defunct Heritage Bank customers are delaying the payment of their insured deposits.

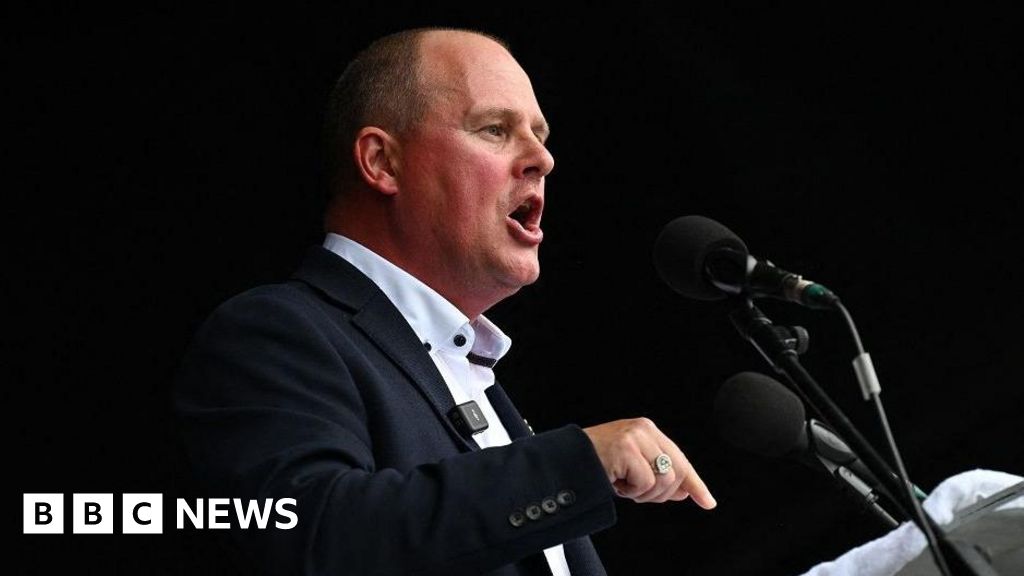

Bello Hassan, the managing director of NDIC, told the News Agency of Nigeria (NAN) on Sunday in Abuja.

Mr Hassan said the corporation had paid a substantial amount to depositors of the defunct bank without BVN account-linked issues.

He called on depositors of the bank who were yet to receive their insured deposit credit alert to visit the NDIC’s website and complete their verification forms for their payment.

The managing director said the verification would include depositors without BVN alternate accounts.

”We have already commenced the payment of customers since June 6.

”We have paid a substantial amount to the customers.

Nigerians need credible journalism. Help us report it.

PREMIUM TIMES delivers fact-based journalism for Nigerians, by Nigerians — and our community of supporters, the readers who donate, make our work possible. Help us bring you and millions of others in-depth, meticulously researched news and information.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Will you support our newsroom with a modest donation to help maintain our commitment to free, accessible news?

”What we leverage in making the payment is the BVN of customers. We trace alternate accounts in other banks and pay them their insured amounts.

”There are some that we have challenges linking up because of some discrepancies between the names and others.

”We are calling on customers that have not received their alerts in their alternate accounts to come forward and complete their verification forms so that we can pay them,” he said.

On payment of depositors with more than five million naira with the bank, Mr Hassan said they would be paid liquidation dividends.

According to him, NDIC has already commenced the process of disposing of the physical buildings and also set the process in motion to make sure that it recovers the loans and advances that were granted the bank.

”That is what we use in paying those liquidation dividends.

”We are not going to wait until we recover everything, no.

”As we recover, we will also advertise to say that we will pay liquidation dividends so that concerned depositors will be on the look out for alerts in their accounts,” Hassan said.

The Central Bank of Nigeria (CBN) on 3 June revoked the banking licence of Heritage Bank Plc.

CBN said the decision was made due to the bank’s failure to improve its financial performance, posing a threat to financial stability. (NAN).

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·