The Small and Medium Enterprises Development Agency and economists have stated that the rise in Nigeria’s public debt might create macroeconomic challenges especially if the debt service burden continues to grow.

They disclosed this on Monday while reacting to the national public debt figure of N134.3tn as of the second quarter of 2024.

Data obtained from the Debt Management Office indicated that as of June 2024, the country’s total public debt reached N134.3tn.

With the National Bureau of Statistics putting the country’s population as at the last count in 2022 at N216.7m persons, comprising 108.3million for males and 108.4million for females, it would mean that debt per capita stands at N619,501 based on the latest debt figure released by the DMO.

The data from DMO sighted by The PUNCH on Monday stated that “The total Public debt is N134tn. This is for public debt stock – external and domestic debt of the FGN (Federal Government of Nigeria), states, and FCT (Federal Capital Territory) as of June 30, 2024.”

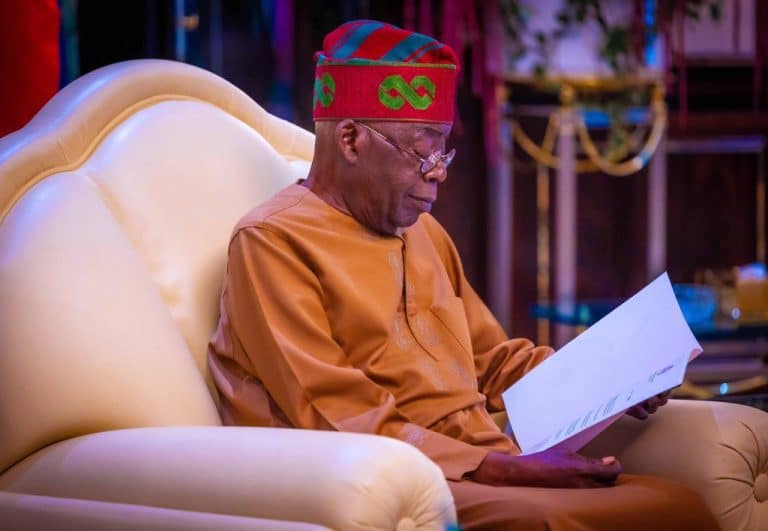

Reacting to this, the Director-General of the Small and Medium Enterprises Development Agency, Charles Odii, stated that while the debt figure, which predates the current administration, looks high, reforms initiated by President Bola Tinubu have yielded positive results and are moving the nation towards stability.

Odii explained that in just 17 months, the administration has reduced the debt service-to-revenue ratio from a staggering 97 per cent to a more manageable 67 per cent.

“This gives the government some breathing room and allows for increased spending on development, including support for small businesses,” Odii said.

According to him, a key priority for SMEDAN is to promote a government-wide understanding of SMEs as the primary drivers of economic growth.

“We advocate for increased investment in SME development, including infrastructure and affordable financing. Our initiative seeks to empower our local producers with guidance, resources, opportunities, and workforce support,” he said.

The SMEDAN DG maintained that Nigeria needs to diversify and grow its revenue base, adding that the group is convinced that investment in SMEs is the way to achieve this.

“Thankfully, this is a sentiment shared by the President, and we are working with state governments across the country on dedicated support to small businesses as a way to achieve financial stability and address social problems like unemployment and insecurity,” he said.

On his part, the Chief Executive Officer of the Centre for the Promotion of Public Enterprises, Dr Muda Yusuf, explained that the situation could lead to a vicious circle, warning that “we don’t end up in a debt trap.”

He said, “I think there is a need for us to be very conscious of and watch the rate of growth of our public debt. Because it could create macro-economic challenges especially if the burden of debt service continues to grow.”

He maintained that there is a need for the government to reduce the exposure to foreign debts because the number has grown so due to the exchange rate.

“It could lead to a situation where we now begin to resort to huge deficit financing and more debts. It can degenerate into a vicious circle so that we don’t end up in a debt trap. So we need to watch it, and also reduce our exposure to foreign and domestic debts because the numbers have grown so high because of the exchange rate.

“You know when you convert our foreign debt at the current exchange rate that is what has blown up the figure. So we need to watch and watch our exposure to foreign debts, even domestic debts because the cost of borrowing now is extremely high. You look at the returns from the Federal Government bonds and special desks. They are very high and these things are indications for the cause of debt service,” he said.

Yusuf noted that this is “the reason we need to be very cautious, we need to work more on fiscal consolidation especially now that we have been told that the reforms have been generating more revenue for the government. If that is the case we should be seeing less challenge around issues of debts.

“So if we need to rationalise our public expenditure be it so that we can keep the whole macroeconomic environment within a fiscal obtainable space. I think we need to review the pace of debt accumulation in the light of the risk that the growing debt service could pose for the macroeconomic.”

In a report by The PUNCH last week, bankers warned that the continued growth of Nigeria’s debt may weaken investor confidence, limit foreign direct investment, and further destabilise the country’s fragile economy.

Speaking under the aegis of the Association of Senior Staff of Banks, Insurance, and Financial Institutions, as well as the National Union of Banks, Insurance, and Financial Institutions Employees, they said the mounting debt has intensified scrutiny over Nigeria’s financial health.

This reality places Nigeria on a challenging fiscal trajectory, where debt servicing costs already consume a sizable portion of government revenue, leaving less room for critical investments in sectors like education, healthcare, and infrastructure.

The bankers mentioned that Nigeria’s debt burden is largely due to its reliance on foreign loans to cover budget deficits.

1 day ago

26

1 day ago

26

English (US) ·

English (US) ·