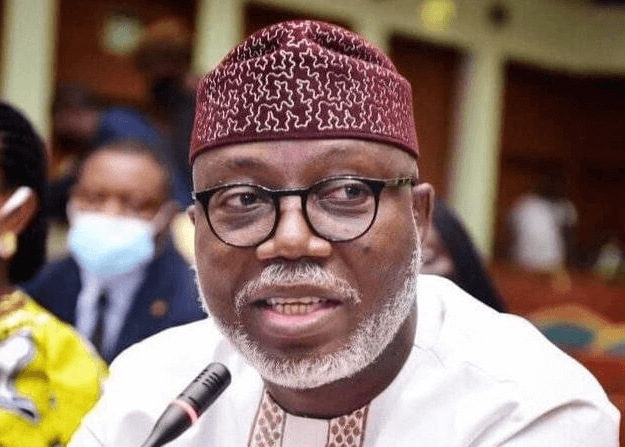

On Friday, the Enugu State Internal Revenue Service Chairperson, Emmanuel Nnamani, said the state generated N35.9 billion in the first seven months of 2024.

Mr Nnamani disclosed this in Enugu while speaking at a programme to mark his first anniversary in office.

He said the state could record the feat owing to the machinery Governor Peter Mbah put in place to boost revenue collection and block leakages.

According to him, the revenue was generated through e-ticket sales, Pay-As-You-Earn collection, land use charges, withholding, capital gain, and consumption taxes, among other things.

“We can say that in seven months of 2024, the state has recorded N35.9 billion in Internally Generated Revenue (IGR), compared with N33.9 billion recorded for the whole of 2023.

“This gives us an average collection of N5 billion every month,” he said.

Mr Nnamani explained that when he came on board, he introduced e-ticketing for collecting taxes from the informal sector, capturing markets, transporters, artisans, etc.

Nigerians need credible journalism. Help us report it.

PREMIUM TIMES delivers fact-based journalism for Nigerians, by Nigerians — and our community of supporters, the readers who donate, make our work possible. Help us bring you and millions of others in-depth, meticulously researched news and information.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Will you support our newsroom with a modest donation to help maintain our commitment to free, accessible news?

He described e-ticketing as a disruptive means of informal sector tax collection.

He noted that in the informal sector, taxes were paid to non-state actors instead of the government’s coffers before now.

“This year, we have recorded over N2.3 billion from the informal sector and it is an achievement.

“We also discovered that in the core area of taxes like Pay-As-You-Earn Tax, withholding taxes on individuals, only a few companies remit these taxes to Enugu government,” he said.

He further said the government had digitalised tax collection by expanding the gateway to six, including InterSwitch, Remita, E-transact, portal, and Monie Point.

“All these are to ease our ways of tax collection, and with this little effort, our taxes have begun to rise.

“There were dormant taxes also that we activated such as Capital Gain Tax to boost IGR generation.

READ ALSO: Enugu govt demolishes kidnappers’ hideouts, recovers arms, ammunition

“We equally activated purchase tax, which had not been activated for collection. They are majorly on hotels and other support services in the state like sales of beer, cigarettes, cars and others,” he said.

He added that the government expanded the collection of land use charges by activating the Geographic Information System.

“We have proof that the number of properties within Enugu Metropolis and sub-urban are more than 290,000, and we want to make sure every single property owner pays land use charge,” Mr Nnamani said.

(NAN)

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·