- Data from the Central Bank of Nigeria (CBN) shows that dollar inflows by IMTOs grew by 47%

- The increase by the international money transfer organisation increased to $2.33 billion in the first half of this year

- The development came when CBN implemented policy measures, allowing eligible IMTOs access to naira liquidity

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

According to data by the Central Bank of Nigeria (CBN), dollar inflows by international money transfer organisations (IMTOs) to Nigeria grew by 47% to $2.33 billion in the first six months of 2024 from $1.58 billion in 2023.

The development came when the apex bank implemented policy measures, allowing eligible IMTOs access to naira liquidity at the official FX window.

Source: Getty Images

CBN policies boost naira inflows

The apex bank recently implemented some policy measures to make FX markets more efficient and raise remittance flows via formal channels.

A circular signed by the bank’s acting Director of the Trade and Exchange Department, W.J. Kanya, disclosed that the measure would enable IMTOs to access local currency liquidity at the official window to settle diaspora remittances promptly.

CBN said:

“Therefore, eligible IMTO operators will be able to access the CBN window directly or through their authorised dealer banks to execute transactions for the sale of foreign exchange in the market.”BusinessDay reports that, according to the CBN figures, Nigeria’s net FX exchange inflows into the economy rose by 67.8% to N27.6 billion in the first half of 2024 from $16.44 billion in 2023.

Nigeria records massive inflows in 2024

The financial institution’s quarterly data showed that the development was due to a 34.6% increase in net inflows via autonomous sources and a 170% increase in net FX inflow through the CBN in the same period.

FX inflows to the Nigerian economy rose 41.6% to $47.73 billion in the first half of 2024, up from $33.7 billion in the same period last year.

The country’s FX inflows via autonomous sources also rose by 47.6% yearly to $31.15 billion in 2024 from $21.16 billion in 2023.

External reserves rise to $40 billion

Legit.ng earlier reported that Nigeria’s foreign reserves rose to $40.2 billion in October 2024, up from $38 billion recorded in September.

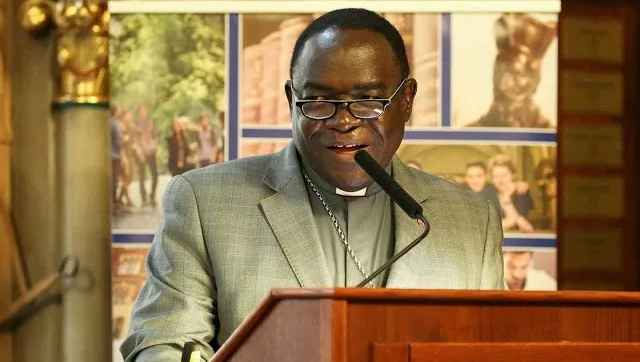

The governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, disclosed this during an investors’ meeting in Washington, DC, on Wednesday, October 23, 2024.

At the meeting, Nigeria’s minister of finance, Wale Edun, said the inflows were organic due to the government’s decision not to defend the naira.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng

English (US) ·

English (US) ·