The Central Bank of Nigeria (CBN) has said that there is no plan to stop the circulation of the old denominations of Naira banknotes.

In a statement that was issued late Thursday night, the central bank said it was reacting to insinuations in some quarters suggesting that the old series of the N200, N500, and N1,000 banknotes will cease to be legal tender on December 31, 2024.

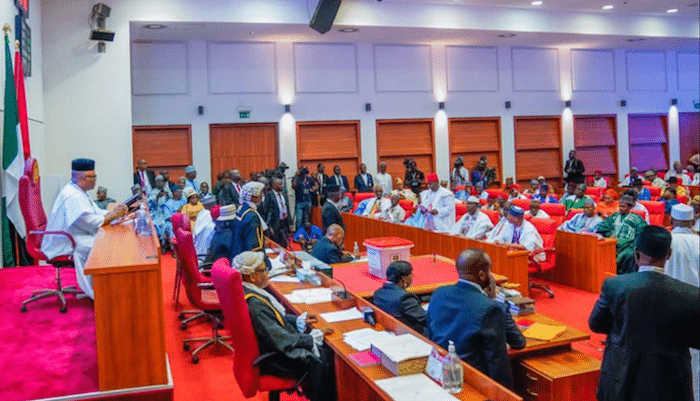

LEADERSHIP reports a Wednesday resolution of the House of Representatives following adoption of a motion urging the CBN to increase the circulation of the redesigned Naira notes since the old ones will cease to be legal tender by December 31, 2024, citing a subsisting ruling of the Supreme Court on the matter.

But, apex bank stated: “We wish to state categorically that such claims are false and calculated to disrupt the country’s payment system. For the avoidance of doubt, the order of the Supreme Court of Nigeria on Wednesday, November 29, 2023, granting the prayer of the Attorney-General of the Federation and Minister of Justice to extend the use of old Naira banknotes ad infinitum, subsists.

“Similarly, the CBN’s directive to all its branches to continue to issue and accept all denominations of Nigerian banknotes, old and re-designed, to and from deposit money banks (DMBs) remains in force. It will be recalled that the Supreme Court ordered that the old series of N200, N500, and 1,000 banknotes shall continue to be legal tender alongside the redesigned versions.

“Accordingly, all banknotes issued by the Central Bank of Nigeria (CBN) will continue to remain legal tender indefinitely. We, therefore, advise members of the public to disregard suggestions that the said series of banknotes will cease to be legal tender on December 31, 2024.”

“We urge Nigerians to continue to accept all Naira banknotes (old or redesigned) for their day-to-day transactions and handle them with the utmost care to safeguard and protect their lifecycle,” the bank’s acting director of corporate communications, Hakama Sidi, added in the statement.

She also urged the general public to embrace alternative modes of payment, e-channels, in order to reduce pressure on the use of physical cash.

20 hours ago

79

20 hours ago

79

English (US) ·

English (US) ·