The Kwara State Government has clarified the recent tax deductions from workers’ salaries following the implementation of the new minimum wage.

It explained that these deductions were in line with statutory requirements and part of a previously agreed adjustment with labour unions and the private sector.

In a statement signed by the Ag. Head, Corporate Affairs Department, Kwara Internal Revenue Service, Funmilola Oguntunbi, on Friday, the government defended the deductions, which include Personal Income Tax and other statutory contributions, as a necessary step toward ensuring fiscal responsibility and sustainable employee welfare.

Oguntunbi emphasised, “In accordance with legal obligations, the gross income of workers is subject to statutory deductions, including Personal Income Tax, pension contributions, National Health Insurance Scheme (NHIS), National Housing Fund (NHF), and insurance, where applicable.”

Regarding the legal basis for the tax deductions, she noted, “Personal Income Tax: A Statutory Obligation. Section 3 of the Personal Income Tax Act (PITA) 2011 (as amended) mandates that Personal Income Tax is a compulsory, first-line charge on gross income. The PITA is a law made by the National Assembly with general application in all the States of the Federation, including Kwara State.”

The government also clarified that adherence to these legal requirements is essential to prevent sanctions from the federal government.

“Historically, the non-compliance with these statutory provisions in the State has had various consequences, including impacts on employees. The inconsistency in tax deductions by MDAs has led to under-remittance of PAYE, affecting both the state’s revenue for developmental projects and employees’ personal obligations,” the statement explained.

Due to prolonged issues with compliance, Kwara has accrued a Pay-As-You-Earn liability exceeding N4 billion from 2010 to 2023, mainly due to the use of an incorrect tax table.

The state currently ranks 18th in the 2023 PAYE ranking, despite its strong performance in other internally generated revenue (IGR) areas.

Oguntunbi highlighted that the government remains dedicated to employee welfare and effective tax administration.

She stated, “The government remains dedicated to both employee welfare and fiscal responsibility, fostering effective tax administration for sustainable development.”

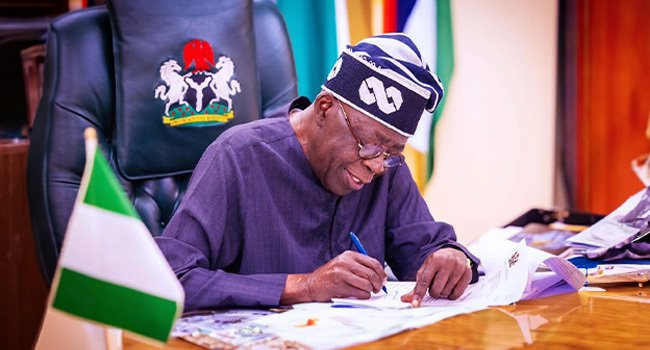

The state governor, AbdulRahman AbdulRazaq, recently approved a minimum wage of N70,000 for the least-paid public service workers, effective from October 2024, aligning with federal directives.

However, the organised labour unions in the state criticized the significant tax increase accompanying the new wage, calling for an immediate reversal.

The labour unions had expected tax relief in line with earlier negotiations with the government, which they claimed would have cushioned the financial impact on workers.

In a joint statement, the labour unions expressed their dissatisfaction, “The State Action Committee (SAC) of Joint Labour Centres met today to review the outcome of the new minimum wage payment to Kwara workers as approved by His Excellency, Governor AbdulRahman AbdulRazaq. The committee observed with dismay the notorious percentage tax deducted from our members’ salaries.

The labour unions stressed their disappointment in the government’s action, emphasising that the higher deductions went against their earlier agreements for tax relief upon implementing the new minimum wage.

With this clarification, the government reiterates its commitment to balancing employee welfare with fiscal accountability while ensuring that Kwara complied with federal tax laws to support its developmental goals.

1 hour ago

27

1 hour ago

27

English (US) ·

English (US) ·