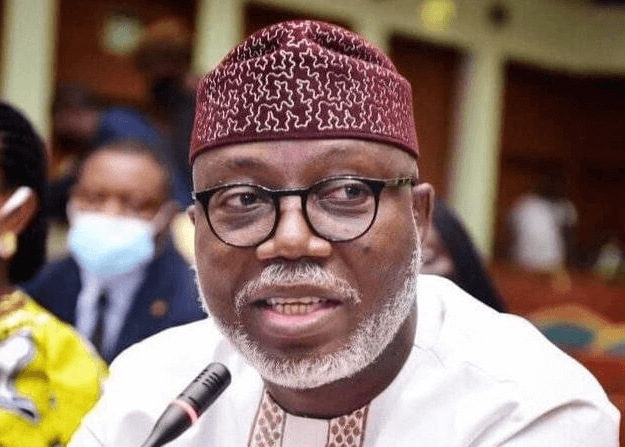

Managing Director of the Nigerian Education Loan Fund (NELFUND), Akintunde Sawyerr, has disclosed that the Fund hopes to receive between 250,000 to 300,000 applications for the student loan scheme this year.

Sawyerr made this remark during an interview with Channels TV on Monday in Abuja.

He mentioned that the number of applicants from the non-academic sector might be significantly lower since that part of the scheme is just commencing.

The NELFUND boss however assured that the Fund has sufficient budget to cover all two million students in tertiary institutions across the country.

He also said the loan is open not just for prospective students, but also to students who are already in various public institutions.

“Currently today in tertiary institutions across the board including the private sector, there are about two (2) million people. This loan is open to those who are already in the institutions. This is not about those coming in only.

“This is about if you apply for a loan today, for the next session, you will get it.

“Arguably, we can give everybody a loan. The funds are available to make for us to cover those sorts of numbers over time.

“This year, we expect to have 250,000 to 300,000 applicants from the academic side. We are going to have less than that for the vocational side because we are just kicking that process off,” Sawyer said.

Speaking on loan recovery, Sawyerr said the loan is expected to be deducted directly from the sources of earnings of applicants once they start working.

He said the scheme is also insured to help cover certain risks and exposures that may affect the initiative during the process.

Sawyer also added that the revised Student Loan Act provides loan forgiveness in certain situations, particularly when the borrower unfortunately dies and is unable to pay back the loan granted to him.

“Because of the potential risk of loss of funds. As you can imagine, if you deploy funds to anything, you can lose that investment. These loans will be insured.

“I should point out that the law makes provisions for forgiveness of debt if the applicant dies. Insurance will take care of some of the risks and exposure.

“It’s worth pointing out that in terms of the loan recovery itself, it will be directly deducted from the source when people start earning,” he said.

4 months ago

5

4 months ago

5

English (US) ·

English (US) ·