The Central Bank of Nigeria has revealed that the net foreign exchange flows into the country increased to $25.4bn in the first six months of 2024, marking a 55 per cent increase from the figure recorded year-over-year.

It stated that the evident progress is a result of its policy measures.

This new development comes against the backdrop of its $876m auction to 26 banks to resolve unmet FX demands.

A statement from the apex bank on Thursday noted that this growth has been fueled by a rise in capital importation, which reached $6bn in June 2024, and record inflows from diaspora remittances through formal channels.

The statement read, “The CBN’s policy objectives are yielding tangible results and bolstering market confidence. Net foreign exchange flows rose to $25.4bn between January and June, marking a 55 per cent year-over-year increase.

“This growth has been driven by a rise in capital importation, which reached $6bn in June 2024, and record inflows from diaspora remittances through formal channels.”

The CBN further noted that over $305m of foreign exchange has been sold to authorized dealers in the last three weeks through a two-way quote system, which has been deployed over the past few months to enhance liquidity in the interbank market.

According to the statement, the CBN offered $876m to meet bids submitted by customers during an auction concluded on Wednesday, August 7, 2024.

This was done through the Retail Dutch Auction System, which is designed to facilitate FX sales to end users directly, promoting a more transparent market, reducing information asymmetry, and aiding in price discovery.

The statement read: “In the latest testament to the Central Bank of Nigeria’s ongoing commitment to support the proper functioning of the foreign exchange market by enhancing liquidity when necessary, the apex bank offered $876m to fulfil bids submitted by customers at an auction concluded on Wednesday, August 7, 2024.

“In line with its pledge to provide transparent access to foreign exchange for all legitimate customers, the CBN’s leadership has introduced an additional mechanism through the Retail Dutch Auction System to directly facilitate FX sales to end users.

“This approach aims to foster a more transparent market, reducing information asymmetry and supporting price discovery. It complements the two-way quote system deployed over the past few months to enhance liquidity in the interbank market, through which over $305m of foreign exchange has been sold to authorised dealers in the last three weeks.”

The apex bank also said that it contributed less than 5 per cent of the $43bn foreign exchange turnover recorded on the official market as of July 2024.

In its statement, the CBN noted that the FX market is showing signs of improvement and increased depth, with more robust and diversified sources of liquidity contributing to the sustained convergence of exchange rates across all market segments.

The statement added, “The foreign exchange market is also showing signs of improvement and increased depth, with more robust and diversified sources of liquidity contributing to the sustained convergence of exchange rates across all segments of the market. The official market recorded a turnover of $43 billion in customer transactions by the end of July 2024, with CBN-supplied liquidity representing less than 5 per cent of total market activities.”

The CBN also stressed that it is committed to fostering a transparent, market-driven foreign exchange environment and will continue to strengthen the market’s capacity to meet the needs of all legitimate participants.

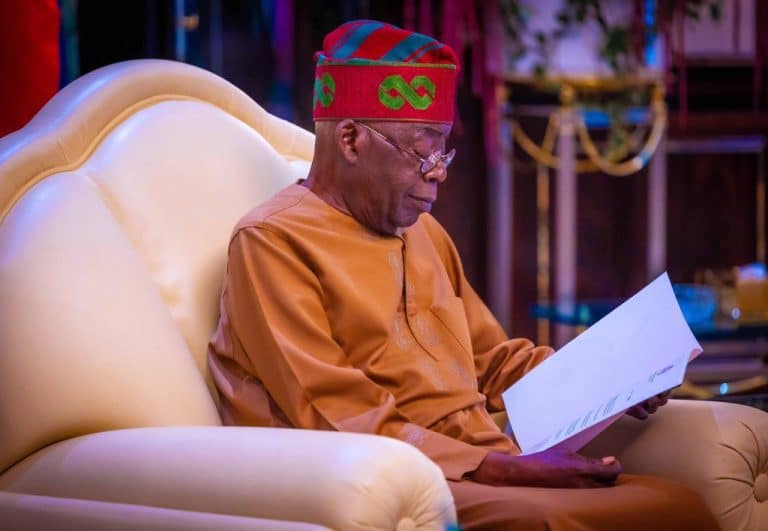

Since he assumed office last year, the CBN under the leadership of Olayemi Cardoso, has employed a variety of policies to stabilise the foreign exchange market and boost productivity.

While government officials claim there have been massive improvements, the lives of average citizens have yet to improve due to soaring inflation and the high cost of living.

3 months ago

96

3 months ago

96

English (US) ·

English (US) ·