Noor Takaful Insurance Limited, the pioneer and leading composite Takaful insurance firm in Nigeria, has distributed a total of onehundred and sixteen million, three hundred and three thousand naira (N116,303,000.00) as surplus to an eligible group of policyholders who did not make claims on their insurance during the 2022 financial year.

The surplus distribution was presented on Wednesday, 13 November 2024, during the second edition of the African Takaful and Non-Interest Finance conference held at Lagos Oriental Hotel, Lagos. The conference was well attended by industry practitioners, relevant stakeholders, international insurance experts, brokers, agents, and the media, among others.

A total of 1,211 participants including individuals, financial institutions, and private and public organizations would receive surplus payments

Sterling Bank Plc, Lotus Bank, WAZOBIA FM, Info FM and Cool FM, The Alternative Bank, Berger Paint, The Crescent Schools were presented with N8,497,799.20, N5,227,641.28, N5,085,045.41, N4,669,942.21, N449,930.61 and N232,158.74, respectively.

Delivering his remarks at the event, the Managing Director of Noor Takaful Insurance Limited, Rilwan Sunmonu, disclosed that since the company’s inception of surplus distribution in 2018, more than 5,000 participants have received surplus, totaling more than N400 million.

According to Sunmonu, this milestone is a testament tothe unwavering commitment of the company to the principles of Sharia and to its valued participants.He expressed confidence in growing thenumber of participants so that it would continue to positively impact lives.

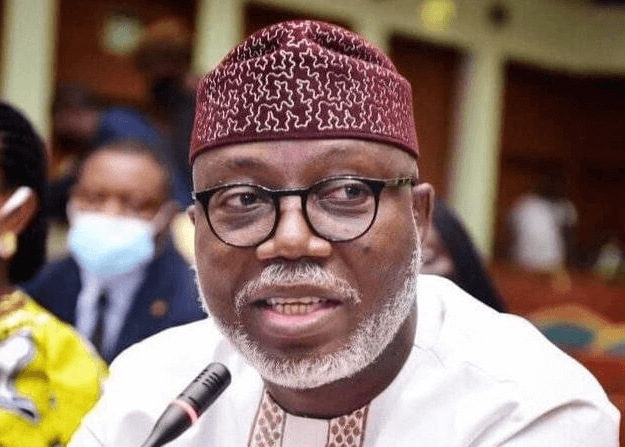

L-R: Member, Advisory Council of Experts, Noor Takaful Insurance Limited, Warshu Tijani-Rabiu; Head, Transaction Banking, The Alternative Bank, Dumebi Oshunkeye; Managing Director, Noor Takaful Insurance Limited, Rilwan Sunmonu and Chief Technology Officer, Noor Takaful Insurance Limited, Taofeek Solabi during the presentation of N4.6m worth of surplus distribution to the Alternative Bank at the second edition of African Takaful and Non-Interest Finance Conference in Lagos Wednesday

L-R: Member, Advisory Council of Experts, Noor Takaful Insurance Limited, Warshu Tijani-Rabiu; Head, Transaction Banking, The Alternative Bank, Dumebi Oshunkeye; Managing Director, Noor Takaful Insurance Limited, Rilwan Sunmonu and Chief Technology Officer, Noor Takaful Insurance Limited, Taofeek Solabi during the presentation of N4.6m worth of surplus distribution to the Alternative Bank at the second edition of African Takaful and Non-Interest Finance Conference in Lagos WednesdayHighlighting the decision to present Surplus to participants through a digital transfer simulation—marking a significant shift from the traditional use of dummy cheques—he statedthat the new approach is a demonstration of its commitment to innovation and efficiency, which is geared towards delivering seamless experiences to participants. He went further to describe the digital presentation of surplus to customers as a reflection of the company’s vision and commitment to moving forward as a company.

Nigerians need credible journalism. Help us report it.

Support journalism driven by facts, created by Nigerians for Nigerians. Our thorough, researched reporting relies on the support of readers like you.

Help us maintain free and accessible news for all with a small donation.

Every contribution guarantees that we can keep delivering important stories —no paywalls, just quality journalism.

Also, the Vice-Chairman of Noor Takaful Insurance Limited, Aminu Tukur, disclosed that the company, which has 15,000 participants, has paid N9 billion in claims in the last seven years.

Tukur noted that the payment of surplus exemplifies the company’s commitment to offering Sharia-compliant solutions to customers.He disclosed that non-interest finance or Islamic finance, as it is regulated in Nigeria remains the only kind of finance that offers a fairer alternative to customers, urging them to take advantage of it.

Noor Takaful Insurance Ltd., a takaful insurance firm established and duly licensed by NAICOM in April 2016 as the first full-fledge composite takaful insurance operator in Nigeria with a 100 percent indigenous Nigerian shareholding. The company currently plays the pioneering and leading role in unlocking takaful insurance potential for Nigeria. Its operational framework is regulated by NAICOM and is subject to the Insurance Act 2003.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·