- Every point-of-sale provider using PalmPay's platform will have to register with the Corporate Affairs Commission

- This is in line with the 2013 Central Bank of Nigeria recommendations on Agent Banking and CAMA 2020

- To make the registration process easier, PalmPay's Business App now includes the CAC registration portal

Legit.ng journalist Zainab Iwayemi has over 3-year-experience covering the Economy, Technology, and Capital Market.

All point-of-sale operators utilizing PalmPay's platform will need to submit their CAC certificates or register with the Corporate Affairs Commission by July 7, 2024, in order to keep their accounts from being frozen.

PalmPay stated that the registration mandate adheres to the 2013 CBN recommendations on Agent Banking. Photo Credity: Palm Pay, Mihailomilovanovic

PalmPay stated that the registration mandate adheres to the 2013 CBN recommendations on Agent Banking. Photo Credity: Palm Pay, MihailomilovanovicSource: Getty Images

This mandate adheres to the 2013 Central Bank of Nigeria recommendations on Agent Banking as well as Section 863 (1) of the Companies and Allied Matters Act 2020, according to a statement made available to ThePunch on Thursday, July 4.

It stated,

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

“Following CAC’s Directive for POS operators to register and submit their CAC details on or before July 7, 2024, PalmPay is encouraging its Business users who have not yet complied with the directive to do so promptly.“This directive follows Section 863 (1) of the Companies and Allied Matters Act 2020 and the 2013 CBN guidelines on Agent Banking.”Recall that in accordance with regulatory requirements and the Central Bank of Nigeria's regulations, Point of Sale companies were fiven two months to register their agents, merchants, and persons with the commission. This deadline was announced by the Federal Government through the Corporate Affairs Commission.

The CAC registration portal has been incorporated into PalmPay's Business App to streamline the registration process. Operators can now easily register their companies and submit the necessary paperwork thanks to this.

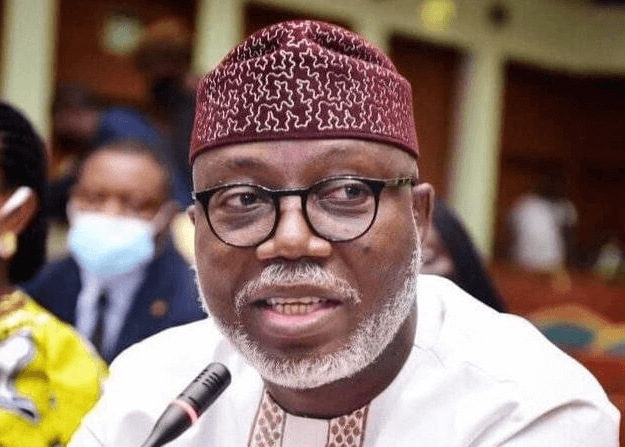

Umuteme Enakeno, Head of Marketing and Communications at PalmPay, stated that the company accepted the CAC's decision.

Enakeno said,

“PalmPay fully supports the CAC’s directive. We provide 24/7 customer support and conduct weekly meetings to guide operators through the process.”He noted for assistance, operators can contact PalmPay customer support via phone, email, or by visiting any of the 36 state offices across Nigeria.

He noted

“Register Your Business via the PalmPay Business App: Ensure that all necessary documents and information are provided accurately before submitting your application. Update Your PalmPay Account Once you get the certificate, update your business details in your PalmPay account to reflect your new corporate status.“We urge all PalmPay Business customers to submit or register their CAC before the deadline. Failure to do so means that the account would be frozen.”According to new reports, Point of Sale providers operating under the National President of the Nigerian Association of Mobile Money and Bank Agents have decided to take the required Corporate Affairs Commission for their members to court to challenge its validity.

Palmpay, others to block PoS operators’ accounts

Legit.ng reporeted that Nigerian banks and fintech companies are set to block accounts of Point of Sale (PoS) operators yet to register their businesses with the Corporate Affairs Commission (CAC) before July 7, 2024.

Legit.ng earlier reported that the Central Bank of Nigeria, in a memo issued on April 30, 2024, directed all non-individuals on the agent banking authorisation to immediately take steps to register their businesses with the CAC in line with Section 863 of the Companies and Allied Matters Act (CAMA) 2020.

The directive made it mandatory for PoS terminals, whether agents, merchants, or individuals, to register with CAC before the commencement of business.

Source: Legit.ng

![Just In: Edo State Governor, Okpebholo Appoints Finance Commissioner, Five Others [Full List]](https://www.naijanews.com/wp-content/uploads/2024/11/Governor-Monday-Okpebholo.jpg)

English (US) ·

English (US) ·