The Nigeria Labour Congress, NLC, has claimed that the current pension scheme practised by the government is pauperizing workers after retirement.

It said retirement under the present scheme may have become a death sentence for many retirees, stressing that it has many consequences for the behaviour of workers in active service.

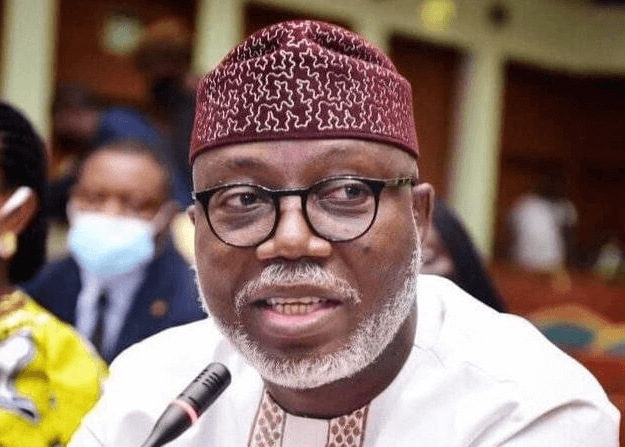

President of NLC, Joe Ajaero, made this statement at a retirement summit in Abuja, with the theme “Challenges, Strategies, Prospects and Opportunities at Retirement in Nigeria.”

He frowned at the alleged over N360 billion pension arrears the federal government owes its retirees.

According to him, the pension scheme has fallen short of its fundamental purpose; to provide for workers in their old age.

He further stated that the medium for storing Pensions which is the Naira has maintained an unstable value and has kept depreciating over the years, adding that only a stable platform that can truly serve as a solid store of value can sufficiently maintain the value of contributions when workers retire.

Ajaero added that pensions were meant to offer security and peace of mind, ensuring that retirees can enjoy their golden years without financial stress and in good health, lamenting that the reality for many workers is starkly different.

The NLC boss expressed worry that most retired members encounter not just health challenges but many others leading to untimely deaths because of the character and nature of the Pension scheme, which according to him pauperizes the retirees financially at retirement.

“Retirement under the present scheme may therefore become a death sentence for many and this has many consequences for the behaviour of workers in active service.

”The federal government is allegedly owing nearly N260 billion in pension arrears, with federal parastatals accounting for an additional N40 billion. Some states have arrears stretching up to eight years. In the private sector, reports indicate that many companies are in arrears of up to three years, deducting contributions from workers’ salaries without remitting them to the respective Pension Fund Administrators (PFAs).

“In 2021, PENCOM according to its fourth quarter 2021 report, appointed recovery agents realised from 36 defaulting employers N984.23 million, representing N406.42 million as principal contribution and N577.87 million as penalty. The Micro-Pensions designed for the informal sector remain inadequately activated, further complicating the financial security of our informal economy workers.

”The non-contributory pension funds are still subject to severe looting by those who are supposed to manage them without consequences. The Maina and the former Accountant General issues are still very fresh in our minds,” he said.

English (US) ·

English (US) ·