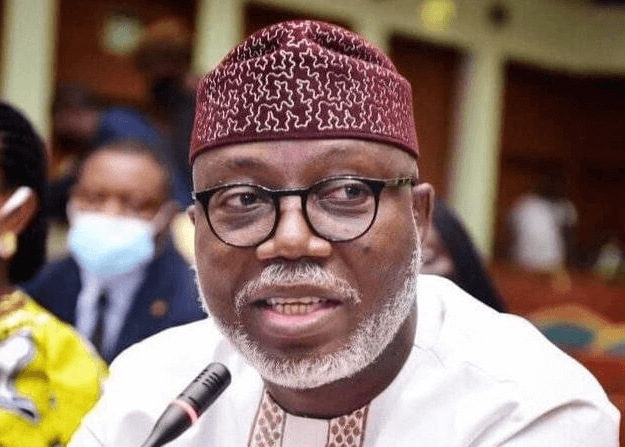

Activist lawyer, Deji Adeyanju, on Monday, informed President Bola Tinubu of the implications of the Nigerian National Petroleum Company Limited reducing its stake in the Dangote refinery from 20 percent to 7.2 percent.

Adeyanju warned President Tinubu that NNPCL’s decision has significant implications for Nigeria’s economy and welfare.

The Chairman of Dangote Group and owner of Dangote Refinery, Aliko Dangote disclosed that the NNPCL reduced its 20 percent stake in Dangote Refinery.

The African richest man noted that the Nigerian oil company now owns only 7.2 percent of the refinery due to the NNPC’s failure to pay the balance of their share, which was due last month in June.

Reacting, Adeyanju said the decision of the NNPCL raises concerns that “warrants immediate attention and transparency.”

In an open letter to Tinubu, the lawyer said the reduction from 20% to 7.2% would amount to a loss in potential revenue for the Nigerian Government.

The letter reads: “As a concerned citizen of Nigeria, I feel compelled to address the recent decision by the Nigerian National Petroleum Company Limited to reduce its stake in the Dangote Refinery from 20% to 7.2%. This decision has significant implications for our national economy and the welfare of Nigerian taxpayers, and it raises several concerns that warrant immediate attention and transparency.

“To provide context, in September 2021, the Nigerian National Petroleum Company Limited acquired a 20% stake in the Dangote Refinery for $2.76 billion. This investment was intended to secure a significant share in the refinery, which is expected to be a crucial asset for Nigeria’s energy sector. The initial financing included $1.036 billion provided by Lekki Refinery Funding Limited, with $1 billion paid directly to Dangote Refinery and $36 million allocated for transaction costs. The remaining $1.76 billion was to be paid through a discount on crude oil prices and future dividends.

“The reduction of NNPC Limited’s stake from 20% to 7.2% represents a substantial loss in potential revenue for the Nigerian Government. The Dangote Refinery is poised to be a critical asset in our nation’s energy sector, and owning a significant share would have ensured a steady stream of revenue through dividends and profit sharing. By reducing its stake, NNPC Limited diminishes its share of future profits, directly impacting the funds available for public services, infrastructure, and other critical needs. This decision essentially sacrifices long-term financial benefits for what appears to be short-term expediency.

“Additionally, this move reduces NNPC Limited’s strategic influence over the refinery’s operations. With a smaller stake, NNPC Limited will have less say in the management and strategic decisions of the refinery, which is a key national asset. This diminished influence could lead to decisions not aligning with our national energy policies or best interests. It raises questions about whether this decision was made adequately considering its broader implications for Nigeria’s energy security and economic stability.

“Moreover, the lack of transparency surrounding this decision is deeply troubling. There has been little or no detailed explanation provided to the public regarding the reasons behind the reduction in NNPC Limited’s shares. Was this decision driven purely by financial constraints, or were there other factors at play? The absence of clear, comprehensive communication from NNPC Limited fuels suspicion and erodes public trust in our institutions. It is imperative that NNPC Limited and the Nigerian government provide a full and transparent account of the motivations and deliberations that led to this decision.

“Furthermore, this decision has direct implications for Nigerian taxpayers. By capping the investment, NNPC Limited avoids potential immediate financial strains, but it also forfeits future financial benefits that could have supported public services and infrastructure development. The reduction in potential revenue could impact the funds available for critical national development projects, thereby affecting the quality of life for Nigerian citizens.

“I urge the Nigerian government and NNPC Limited to reconsider this decision or, at the very least, provide a detailed and transparent explanation to the public. The people of Nigeria deserve to understand the rationale behind decisions that significantly impact our national assets and future prosperity. It is essential to restore public confidence through openness and accountability. Failing to do so will only deepen the distrust and scepticism that many Nigerians already feel towards our institutions.

“In conclusion, the reduction of NNPC Limited’s stake in the Dangote Refinery is a decision laden with negative implications for Nigerian taxpayers and raises serious concerns about transparency and potential foul play. I call upon the Nigerian government and NNPCL Limited to address these concerns promptly and ensure that all future decisions regarding our national assets are made with the utmost integrity and in the best interest of the Nigerian people.”

English (US) ·

English (US) ·