- Nigerian banks have turned to CBN in their search for funds for their operations, borrowed over N1 trillion in hours

- The amount is the highest borrowing recorded according to data from the Central Bank of Nigeria

- Banks obtain funds from the Central Bank of Nigeria (CBN) via the Standing Lending Facility (SLF), which serves as a tool for managing liquidity

Legit.ng journalist Dave Ibemere has over a decade of business journalism experience with in-depth knowledge of the Nigerian economy, stocks, and general market trends.

Deposit Money Banks(DMBs) have used the Central Bank of Nigeria (CBN) Standing Lending Facility (SLF) to secure funds for operation.

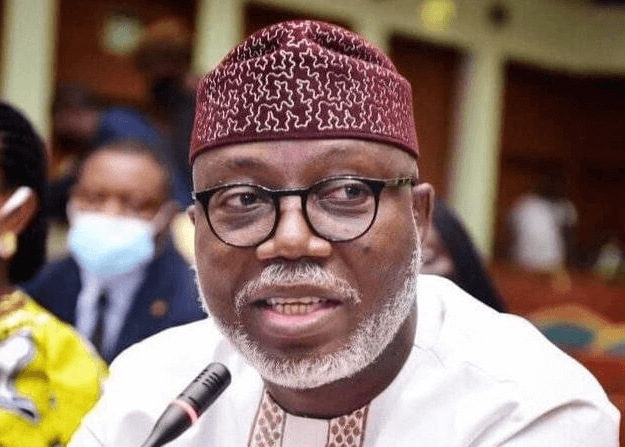

Nigerian banks borrowing from CBN hit a new high

Photo credit: Bloomberg/contributor

Nigerian banks borrowing from CBN hit a new high

Photo credit: Bloomberg/contributorSource: Facebook

A standing lending facility is a means by which central banks offer short-term liquidity to banks experiencing temporary funding shortfalls.

Banks borrowing from CBN

Data from the CBN on Thursday, July 4, 2024, revealed that Nigerian banks borrowed N1.53 trillion in a single day, marking an all-time high.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

This amount represents an increase of over 100% compared to the N11.13 billion borrowed on the same date in 2023.

Why are banks borrowing

BusinessDay reports that banks may need to borrow from the Central Bank to meet immediate obligations, such as covering withdrawals or funding loans.

Banks rely on liquidity to facilitate transactions efficiently.

Analysts attribute this need for Short-Term Liquidity Facility (SLF) borrowing to recent adjustments in monetary policy by the Central Bank, including increased interest rates and tightened credit conditions.

These policy changes have heightened banks' reliance on Central Bank lending for funds.

In its February 2024 Monetary Policy Committee (MPC) meeting, the CBN raised banks' Cash Reserve Ratio (CRR) from 32.5% to 45.0%.

Additionally, in March 2024, it adjusted the CRR for Merchant Banks from 10% to 14%.

Cash Reserve Ratio (CRR) is a specified minimum fraction of the total deposits of customers, which commercial banks have to hold as reserves either in cash or as deposits with the central bank.

CBN issues 4 new directives to banks on domiciliary accounts

Legit.ng previously reported that the CBN has released six new directives on how domiciliary bank accounts should operate in the country

The move is aimed at promoting transparency, discouraging speculation, and ensuring overall stability in the forex market

Access, Zenith, and Guaranty Trust, among several other commercial banks, are expected to make the necessary adjustments

Source: Legit.ng

![Just In: Edo State Governor, Okpebholo Appoints Finance Commissioner, Five Others [Full List]](https://www.naijanews.com/wp-content/uploads/2024/11/Governor-Monday-Okpebholo.jpg)

English (US) ·

English (US) ·