United Capital Plc’s net profit for the three months to March increased 64.3 per cent compared to the figure reported a year earlier, with higher income from its asset management business driving the surge.

Investment income, largely comprised of the earnings from the funds managed by that subsidiary, advanced nearly six times to N6.4 billion, contributing more to turnover than other revenue streams.

Gross earnings rose 113.5 per cent to N13.1 billion, according to the company’s latest earnings report.

United Capital was the investment banking unit of UBA until it was carved out into a separate entity in 2014 after the Central Bank of Nigeria ordered the abolition of universal banking.

The group operates subsidiaries in investment banking, trusteeship, wealth management, micro-lending and consumer finance under a holding company structure.

Fees and commission income, during the review period, grew 72.7 per cent to N4.5 billion on account of a boost in management, brokerage and trustee fees.

Net trading income leapt to N1.5 billion from N632 million a year earlier, an indication that more returns are pouring in from the group’s investment in financial securities.

Nigerians need credible journalism. Help us report it.

Support journalism driven by facts, created by Nigerians for Nigerians. Our thorough, researched reporting relies on the support of readers like you.

Help us maintain free and accessible news for all with a small donation.

Every contribution guarantees that we can keep delivering important stories —no paywalls, just quality journalism.

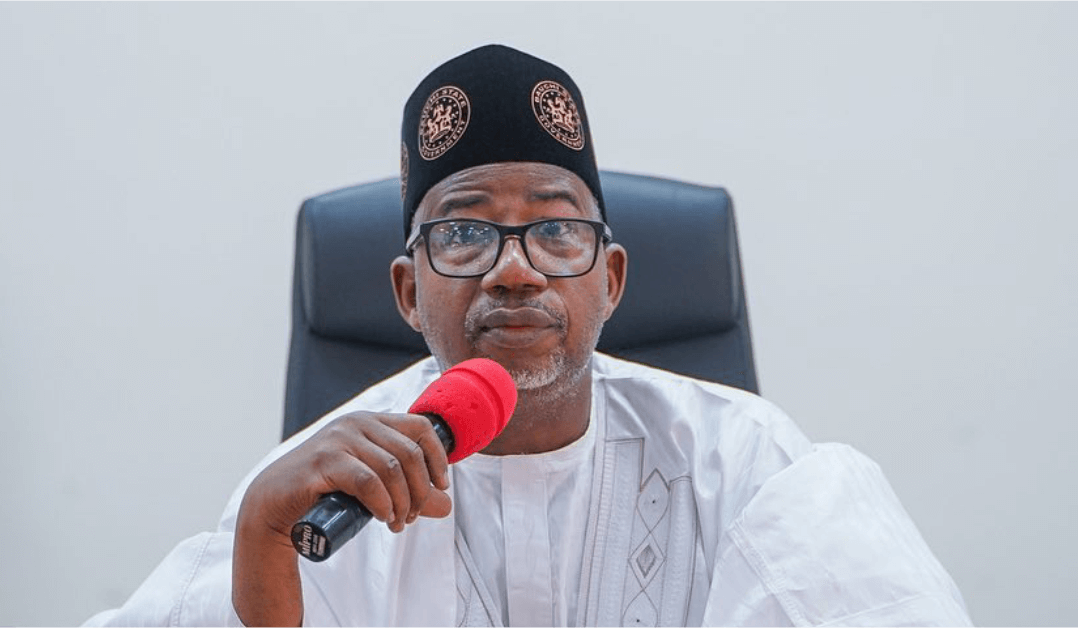

“These results highlight the strength of our business model, effective execution of our transformative and purpose-driven strategy,” said Peter Ashade, the chief executive officer, in a statement on Tuesday.

“Going into the remaining quarters of the year, we are confident that through the diligent execution of our well-thought-out strategies, we are on track to attain new heights,” he added.

READ ALSO: United Capital reports 89% surge in nine-month profit

Other income, which took a hit from an exchange loss of N386.8 million, dropped almost four-fifths to N288.3 million.

Net profit margin, a mark of companies’ capacity to turn revenue into profit, slid to 45 per cent from 58.4 per cent.

Profit before tax jumped to N6.7 billion from N4.1 billion, while profit for the period stood at N5.9 billion, rising from N3.6 billion.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·