Jaiz Bank on Tuesday said it is close to reaching its re-capitalisation requirement of N20 billion as mandated by the Central Bank of Nigeria (CBN).

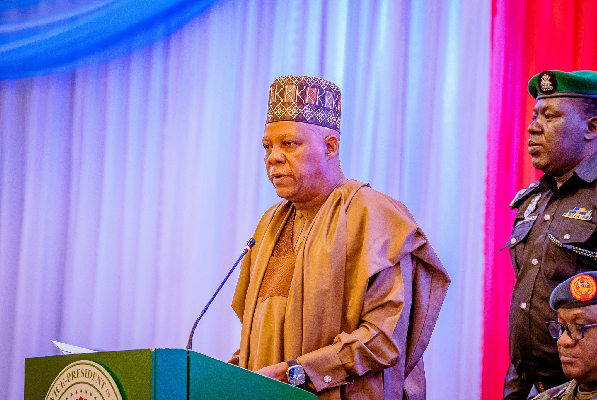

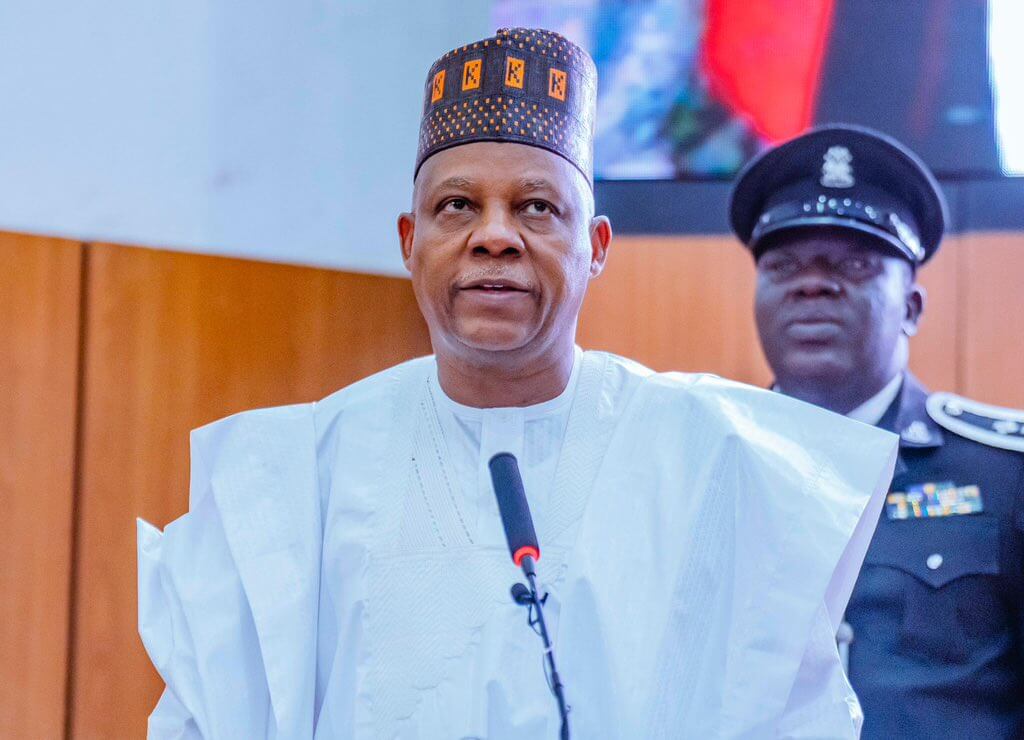

Speaking at the bank’s 12th annual general meeting (AGM) on Tuesday, Haruna Musa, chief executive officer (CEO), said investors have already injected the sum of N10 billion.

Mr Musa said his bank would be the first in the country to complete the re-capitalisation requirement.

“We will be the first bank in Nigeria to close the new CBN capital base.

“Prior to the announcement by the CBN about the new capital structure, our board has been very proactive, by arranging a private placement.

“Our top investors have invested the sum of N10.4 billion looking at our current verified capital by CBN which is about N18.7 billion. We have only N1.3 billion to sort for and we have N10.4 billion to bring in,” Mr Musa said.

According to him, Jaiz bank gross earnings grew to N47.2 billion in 2023, as against N33.2 billion in 2022.

Nigerians need credible journalism. Help us report it.

PREMIUM TIMES delivers fact-based journalism for Nigerians, by Nigerians — and our community of supporters, the readers who donate, make our work possible. Help us bring you and millions of others in-depth, meticulously researched news and information.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Will you support our newsroom with a modest donation to help maintain our commitment to free, accessible news?

He also said Profit Before Tax (PBT) in 2023 was N11.1 billion, a 67 percent increase from the 2022 figure of N6.6 billion.

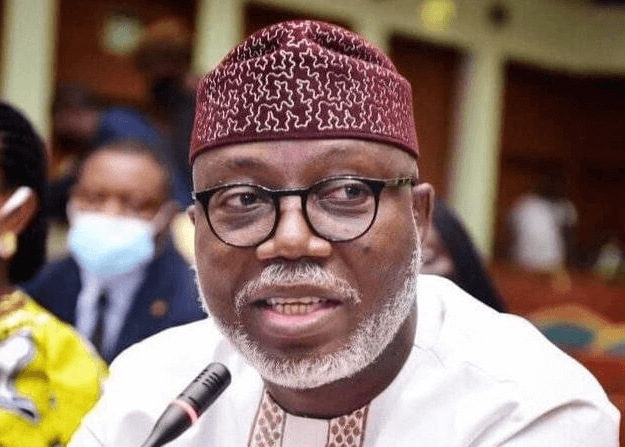

Mohammed Bintube, chair of the board of the bank, said they are working to increase the dividends paid to shareholders.

“These days, our customers mostly use our digital and electronic channels to conduct their various banking transactions.

“It’s the first and biggest non-interest bank in Nigeria. We are the pioneers of the industry and we want to go beyond Nigeria, West Africa, we want to be the leading ethical bank in the whole continent of Africa,” Mr Bintube said.

Re-capitalisation requirement

In March, the apex bank announced an upward review of the minimum capital requirements for commercial, merchant and non-interest banks.

The re-capitalisation requirement for non-interest banks like Jaiz was fixed at N20 billion.

The regulator fixed the capital base for commercial banks with international licences at N500 billion, while national and regional financial institutions’ capital bases were put at N200 billion and N50 billion, respectively.

All banks are supposed to meet the new requirements by 31 March, 2026.

ALSO READ: Jaiz Bank secures $20 million equity investment from Saudi Arabia’s ICD

The apex bank rolled out the new requirements following the ambitious plan of President Bola Tinubu to grow Nigeria’s economy to $1 trillion by 2026.

Speaking at the 29th Nigerian Economic Summit (NES) in October 2023 in Abuja, the president said a $3 trillion economy for the country is possible in 10 years.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·