Japan's top currency official Masato Kanda has said authorities are ready to step into forex markets to support the yen.

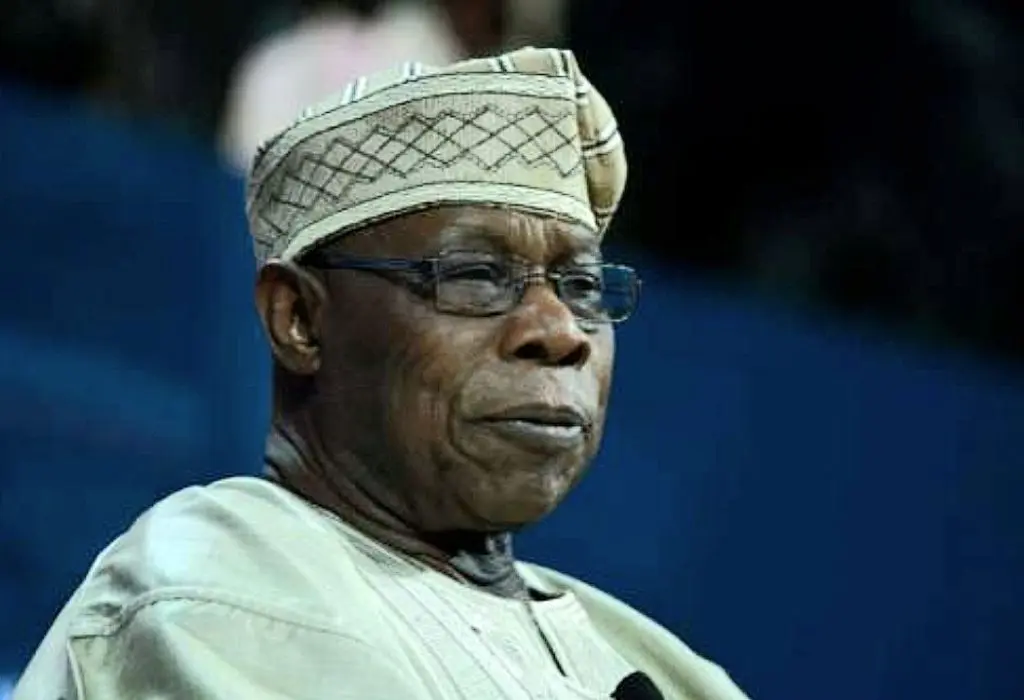

Photo: Stefani Reynolds / AFP

Japan's top currency official Masato Kanda has said authorities are ready to step into forex markets to support the yen.

Photo: Stefani Reynolds / AFPSource: AFP

The yen edged back slightly Thursday after hitting a 38-year low against the dollar, putting investors on alert for a possible intervention by Japanese authorities, while investors awaited US inflation data that could spark another round of volatility.

The Japanese unit's latest retreat came as uncertainty surrounded the Federal Reserve's timetable for cutting interest rates, and the Bank of Japan's caution in tightening monetary policy.

Traders were also selling equities across Asia as tech firms came under pressure amid concerns that a long-running rally in the sector may have been overdone and profit-takers stepped in.

Focus has turned to Tokyo, where vice finance minister Masato Kanda said earlier in the week that authorities were keeping a close eye on movements in forex markets and were ready to step in with yen support 24 hours a day.

Their determination was put to the test after the yen fell to 160.87 per dollar late Wednesday -- its weakest since 1986 -- as US Treasury yields spiked.

Analysts say it is possible traders will keep pushing the envelope to see at what point the government will act, with some saying the target was 165, while others have warned the unit could hit 170.

Billions were pumped in to support the yen after it hit a 34-year low of 160.17 in late April, but with limited effect.

The dollar's surge against the yen is being fuelled by a wide divergence in the monetary policies of the Fed and BoJ, with the US central bank still worried about sticky inflation and Japanese officials trying to avoid damaging the fragile economy.

Friday sees the release of the US personal consumption expenditures (PCE) index, the Fed's favoured gauge of inflation, followed by crucial jobs data a week later.

A forecast-busting read on those could push back expectations for a rate reduction and put further upward pressure on the dollar.

'Strong concerns'

On Thursday, Japanese finance minister Shunichi Suzuki told reporters: "We have strong concerns about (cheaper yen's) impact on the economy. With a sense of urgency, we are analysing the background of this movement and will take necessary measures if necessary."

Meanwhile, the BoJ's July meeting will be scrutinised after it disappointed investors this month by delaying the wind-down of its bond-buying programme that is used to keep borrowing costs down.

There is hope it will hike rates, having done so in March for the first time in 17 years.

Robert Brown, at MAS Markets, said: "Looking ahead, the Japanese yen may strengthen as the BoJ considers reducing bond purchases and raising interest rates.

"However, the rate differentials with other major currencies could continue weighing the yen in the meantime."

Equity markets were down across the board in Asia as investors struggled to pick up a mildly positive lead from Wall Street, with Micron Technology's below-expectations forecast for chip sales adding to pressure on the tech sector.

Hong Kong led losses, while Tokyo, Shanghai, Sydney, Seoul, Wellington and Taipei were also well down.

Singapore, Manila and Jakarta eked out gains.

Key figures around 0230 GMT

Tokyo - Nikkei 225: DOWN 1.0 percent at 39,286.52 (break)

Hong Kong - Hang Seng Index: DOWN 1.9 percent at 17,752.71

Shanghai - Composite: DOWN 0.7 percent at 2,951.33

Dollar/yen: DOWN at 160.55 yen from 160.73 yen on Wednesday

Euro/dollar: UP at $1.0691 from $1.0680

Euro/pound: UP at 84.65 pence from 84.57 pence

Pound/dollar: UP at $1.2629 from $1.2625

West Texas Intermediate: DOWN 0.5 percent at $80.53 per barrel

Brent North Sea Crude: DOWN 0.4 percent at $84.92 per barrel

New York - Dow: FLAT at 39,127.80 (close)

London - FTSE 100: DOWN 0.3 percent at 8,225.33 (close)

Source: AFP

English (US) ·

English (US) ·