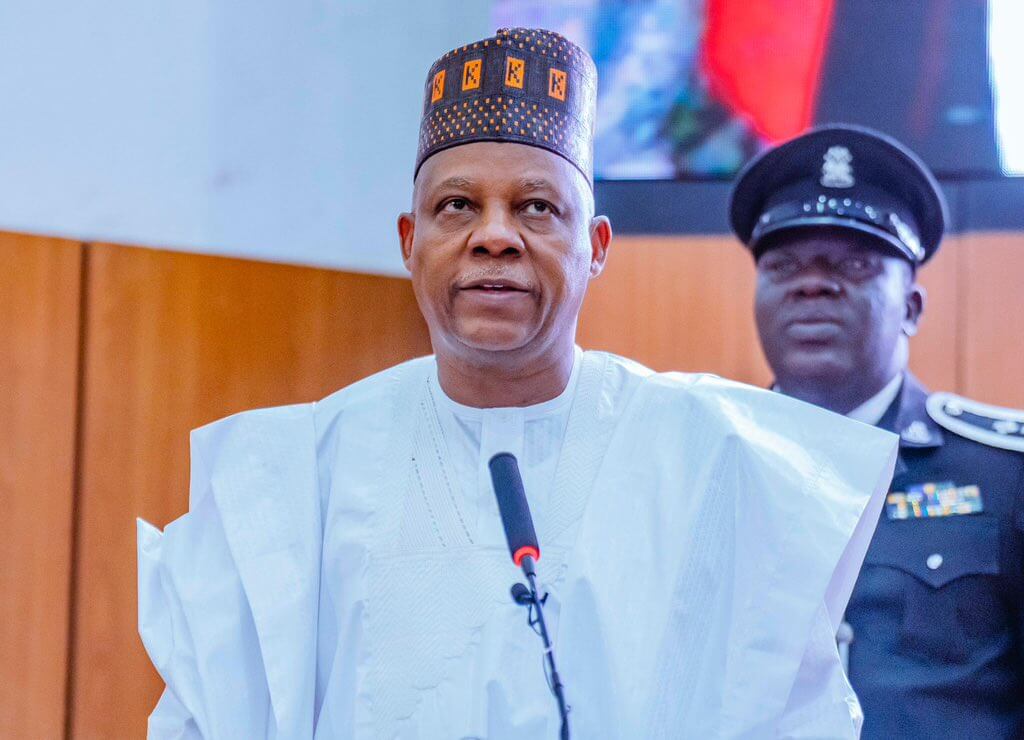

The Vice President, Oil and Gas, at Dangote Industries Limited (DIL), Devakumar Edwin, on Wednesday insisted that International Oil Companies (IOCs) operating in Nigeria have consistently frustrated the company’s requests for locally produced crude as feedstock for its refining process.

The management of Dangote Industries Limited disclosed it in a statement on Wednesday.

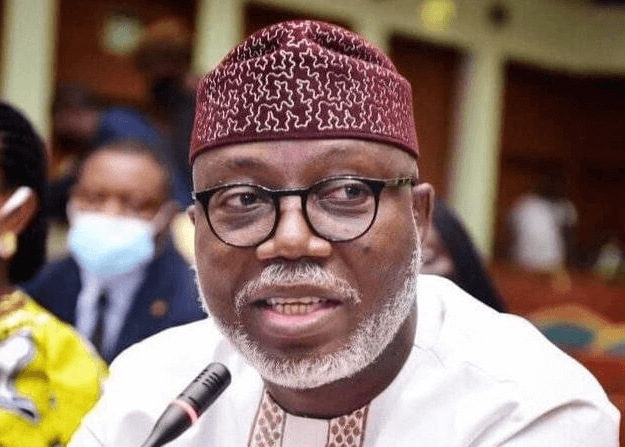

Mr Edwin’s response came against the background of a statement by the Chief Executive Officer of Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Gbenga Komolafe.

Mr Komolafe had in an interview on ARISE News TV said that “it is ‘erroneous’ for one to say that the IOCs are refusing to make crude oil available to domestic refiners, as the Petroleum Industry Act (PIA) has a stipulation that calls for a willing buyer willing seller relationship.”

Last month, Mr Edwin accused IOCs in Nigeria of doing everything to frustrate the survival of Dangote Oil Refinery and Petrochemicals.

He said the IOCs are deliberately frustrating the refinery’s efforts to buy local crude by jerking up high premium price above the market price, thereby forcing it to import crude from countries as far as the United States, with its attendant high costs.

On Wednesday Mr Edwin noted that the NUPRC has been very supportive to the Dangote Refinery as it intervened several times to help the facility secure crude supply.

Nigerians need credible journalism. Help us report it.

PREMIUM TIMES delivers fact-based journalism for Nigerians, by Nigerians — and our community of supporters, the readers who donate, make our work possible. Help us bring you and millions of others in-depth, meticulously researched news and information.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Will you support our newsroom with a modest donation to help maintain our commitment to free, accessible news?

However, he said the NUPRC chief executive was probably misquoted by some people hence his statement that IOCs did not refuse to sell to the company.

“To set the records straight, we would like to recap the facts below. Aside from Nigerian National Petroleum Company Limited (NNPC Ltd), to date we have only purchased crude directly from only one other local producer (Sapetro). All other producers refer us to their international trading arms,” Mr Edwin said.

He explained that these international trading arms are non-value adding middlemen who sit abroad and earn margin from crude being produced and consumed in Nigeria.

“They are not bound by Nigerian laws and do not pay tax in Nigeria on the unjustifiable margin they earn. The trading arm of one of the IOCs refused to sell to us directly and asked us to find a middleman who will buy from them and then sell to us at a margin. We dialogued with them for nine months and in the end, we had to escalate to NUPRC who helped resolve the situation,” Mr Edwin said.

He added that when the company entered the market to purchase crude requirement for August, the international trading arms claimed that they had entered their Nigerian cargoes into a Pertamina (the Indonesia National Oil Company) tender, and it had to wait for the tender to conclude to see what is still available.

“This is not the first time. In many cases, particular crude grades we wish to buy are sold to Indian or other Asian refiners even before the cargoes are formally allocated in the curtailment meeting chaired by NUPRC,” he said.

Commending the NUPRC for its various interventions in the oil company’s crude supply requests from IOCs, and for publishing the Domestic Crude Supply Obligation (DCSO) guidelines to enshrine transparency in the oil industry, Mr Edwin said “If the DCSO guidelines are diligently implemented, this will ensure that we deal directly with the companies producing the crude oil in Nigeria as stipulated by the PIA.”

He highlighted that when cargoes are offered to the oil company by the trading arms, it is sometimes at a $2-$4 (per barrel) premium above the official price set by NUPRC.

“As an example, we paid $96.23 per barrel for a cargo of Bonga crude grade in April (excluding transport). The price consisted of $90.15 dated Brent price + $5.08 NNPC premium (NSP) + $1 trader premium. In the same month we were able to buy WTI at a dated Brent price of $90.15 + $0.93 trader premium including transport.

“When NNPC subsequently lowered its premium based on market feedback that it was too high, some traders then started asking us for a premium of up to $4 million over and above the NSP for a cargo of Bonny Light. Data on platforms like Platts and Argus shows that the price offered to us is way higher than the market prices tracked by these platforms. We recently had to escalate this to NUPRC”, Mr Edwin said.

He urged the regulatory commission to take a second look at the issue of pricing.

“NUPRC has severally asserted that transactions should be on a willing seller/ willing buyer basis. The challenge however is that market liquidity (many sellers/ many buyers in the market at the same time) is a precondition for this. Where a refinery needs a particular crude grade loading at a particular time then there is typically only one participant on either side of the market.

“It is to avoid the problem of price gouging in an illiquid market that the domestic gas supply obligation specifies volume obligation per producer and a formula for transparently determining pricing. The fact that the domestic crude supply obligation as defined in the PIA has gaps is no reason for wisdom not to prevail.

“The $2-$4 is per barrel. It is important that we specify it so people understand the magnitude. Without specifying per barrel may mean it is just $2-$4 on the full value of the cargo, which is insignificant,” he said.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·