The Nigerian government is taking aim at lenders by introducing windfall tax on banks’ foreign currency revaluation gains, hoping to use the proceeds to part-finance its spending plans.

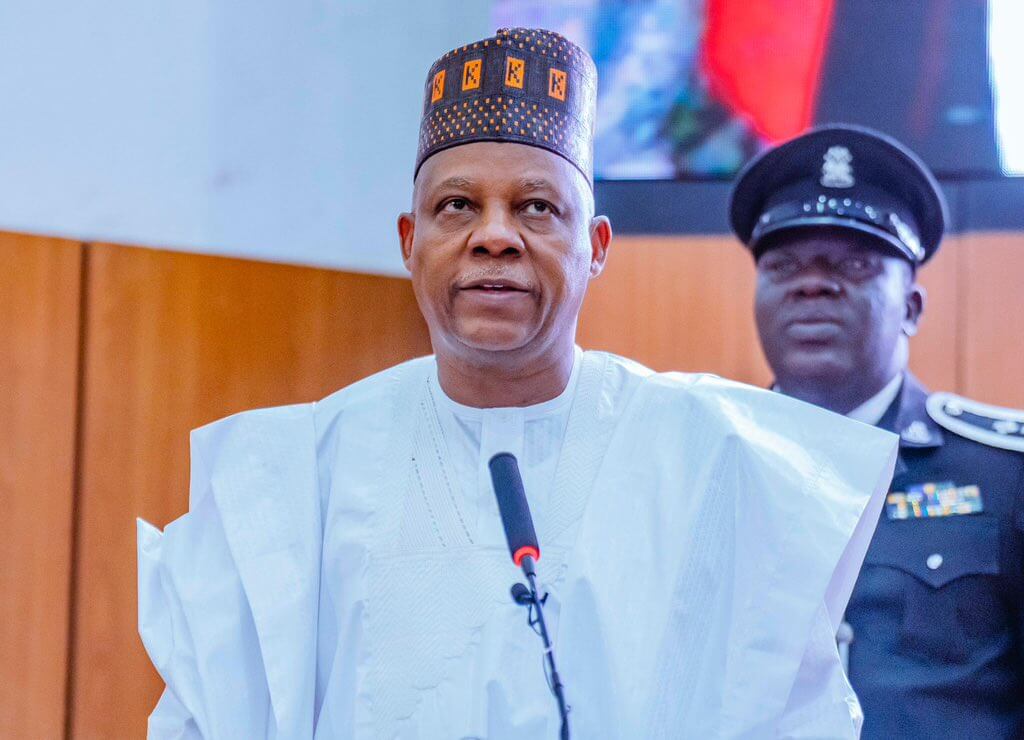

President Bola Tinubu wrote to the Senate, asking it to back a legislation that will tax the bumper income derived by banks last year from the revaluation of their FC-denominated assets after a free fall in the value of the naira caused a surge in the value of such assets when converted into the local currency.

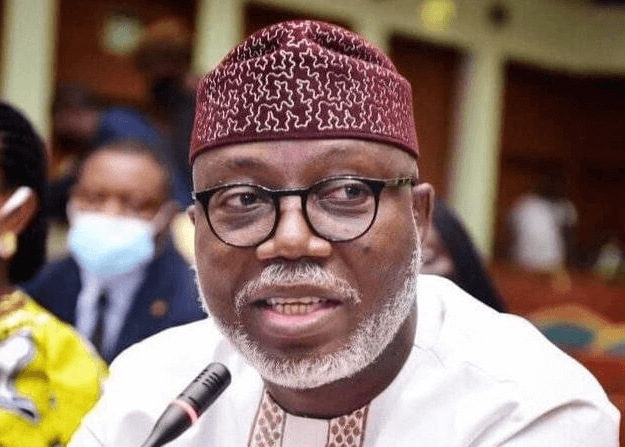

“A proposed amendments to the Finance Act Amendment Bill 2023 are required to impose a one-time windfall tax on the foreign exchange gains realised by banks in their 2023 financial statements,” President Tinubu said in a letter to the Senate, read on the floor of the upper parliament on Wednesday by Godswill Akpabio, the senate president.

The tax will help “fund capital infrastructural development, education and healthcare access as well as public welfare initiatives all of which are essential components of the Renewed Hope Agenda,” he added.

The revenue expansion push is coming nearly ten months after a PREMIUM TIMES analysis of Nigeria’s five biggest lenders’ (FBN Holdings, UBA, GTCO, Access Holdings and Zenith Bank) half-year 2023 financials revealed those banks alone earned N1.3 trillion in foreign exchange revaluation gains, 17 times bigger than that of the corresponding period of 2022.

Nigerian banks are profiting from two of the major economic woes plaguing Africa’s most populous country as it faces a record cost of living crisis that has tipped many into poverty.

While a sticky inflation rate has prompted eleven straight interest rate hikes from monetary authorities, enabling banks to charge more for loans, two devaluation rounds executed within the first seven months of Mr Tinubu’s presidency have caused assets held by banks in foreign currencies to balloon to record levels.

Nigerians need credible journalism. Help us report it.

PREMIUM TIMES delivers fact-based journalism for Nigerians, by Nigerians — and our community of supporters, the readers who donate, make our work possible. Help us bring you and millions of others in-depth, meticulously researched news and information.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Will you support our newsroom with a modest donation to help maintain our commitment to free, accessible news?

Unfortunately, those reforms and policy shifts are pushing many businesses, especially the import-dependent ones to the brink, with some multinationals shutting down their Nigerian operations.

The current move to tax banks’ windfall foreign exchange gains is part of the aggressive plan of the Tinubu’s administration to raise tax revenue’s share of the gross domestic product to 18 per cent from 11 per cent within three years.

Nigeria, which has one of the lowest tax revenue in the world, expects to scale up collection by 57 per cent this year.

“We all know that banks are making huge profits. In fact, that’s why everybody is now willing to set up a bank because of huge amount of money they are getting.

“A bank will declare close to about N500 billion. There is no business you can do in this country where you can get that kind of money,” said Aliero Mohammed, the senator representing Kebbi Central Senatorial District.

Last year, the Central Bank of Nigeria forbade banks from using their foreign exchange revaluation gains from dividend payment purpose, stating that such income should be set aside as rainy day savings that would help lenders mitigate future foreign exchange risks.

“There is no such tax known to the laws of this country as we speak… If I have my way, I will say that we step down the second bill which is about taxation of banks, profits of banks. We cannot grow our economy, we cannot run our government by continually taking our people, whether they are corporate citizens of Nigeria or whether they are individuals,” said Seriake Dickson, who represents Bayelsa West in the Senate.

“Let it not be said that this Senate without the benefit of a public hearing, without the benefit of economic expert, financial experts advising us about the propriety of this legislation, and most importantly also the timing of this legislation,” he added.

Apart from vast foreign exchange gains, the big boom banks are witnessing from interest rate hikes would automatically have been an invitation to windfall tax if it were to be in the West.

Last year, France, Hungary, Italy, Spain and Sweden joined the league of European markets imposing a windfall tax on banks profiting from rate increment, with an economy like Czech going as high as 60 per cent.

Windfall tax receipts helped Nigeria’s African peer South Africa in 2022 to pay down debt and repair public sector infrastructures. The government hopes it could help cut public debt as a share of GDP to 69 per cent by 2024/2025 from 71.4 per cent in 2022/2023.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·